India's vibrant textile heritage and booming fashion industry have fuelled a growing demand for skilled professionals. Fashion education plays a crucial role in bridging this gap, but how does it fare on the global stage?

India’s fashion education sector is booming, with over 3,500 institutes offering programs across design, technology, and management as per All India Council for Technical Education (AICTE). India boasts of a robust network of fashion schools, with the prestigious National Institute of Fashion Technology (NIFT) leading the pack. NIFT consistently ranks among the world's top fashion schools, according to Business of Fashion Global Fashion School Ranking 2023. However, a vast number of private institutions offer varying levels of quality.

Courses span diplomas, undergraduate and postgraduate degrees, catering to diverse interests and career aspirations.

Table: Course offerings

|

Program level

|

Description

|

Example institutions

|

|

Undergraduate degrees (B.Des, BFTech)

|

Comprehensive programs in fashion design, technology, and management.

|

NIFT, Pearl Academy, Symbiosis Institute of Design (SID)

|

|

Diploma courses

|

Skill-oriented programs focusing on specific areas like pattern making or fashion illustration.

|

Numerous private institutes across India

|

|

Certificate courses

|

Short-term programs for beginners or skill enhancement.

|

Design institutes, online platforms

|

Challenges and opportunities

The industry demands graduates with a blend of creative vision and business understanding and technical skills. Many institutions struggle to bridge this gap. Integrating business courses into the curriculum is crucial. For example, The Pearl Academy, known for its fashion programs, recently launched a "Centre for Creative Entrepreneurship" to equip students with business skills for the fashion industry.

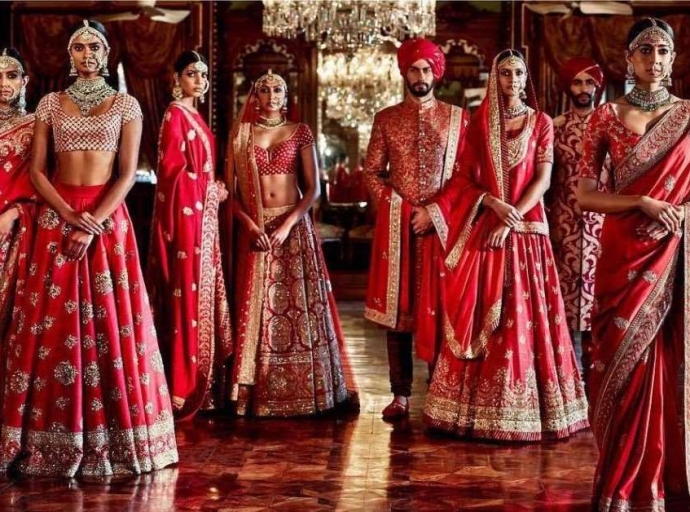

Sustainable practices, digitalization, and technological advancements need to be woven into the curriculum to prepare graduates for the evolving industry. Opportunities lie in incorporating sustainable practices, embracing technology (3D printing, digital design), and fostering entrepreneurship. The need is to democratise this education. As designer Ritu Kumar says, “There's a huge opportunity for Indian fashion education to embrace sustainability and cater to the growing demand for eco-conscious clothing."

Making quality education accessible beyond Tier-I cities and through online or blended learning models can tap into a wider talent pool.

Strengths and need for improvement

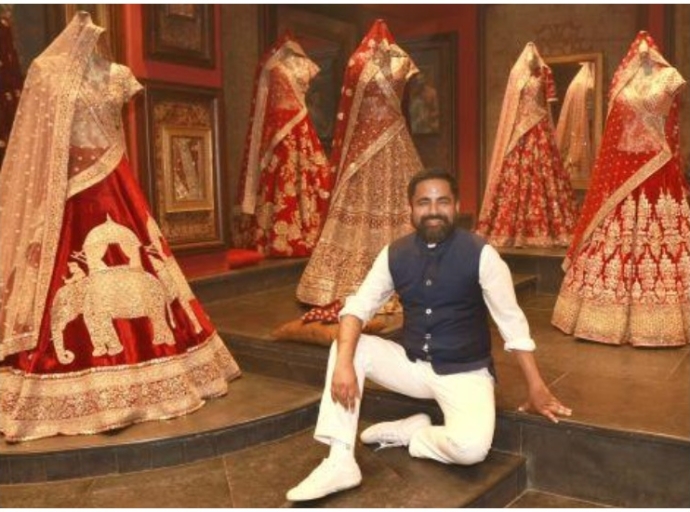

India’s strength is its technical expertise as fashion schools in the country have a strong emphasis on technical skills like draping, pattern making, and construction, which are valued globally. Moreover, India's rich textile heritage is embedded in the curriculum, giving graduates an edge in understanding fabrics and materials.

However, certain areas need improvement. One of them is business acumen as integrating business management, marketing, and branding courses will equip graduates to navigate the commercial side of fashion. Also there is a need for global exposure among student. More international exchange programs and collaborations with renowned fashion schools will broaden student horizons.

The Indian fashion industry is projected to reach $300 billion by 2025 as per IBEF, creating a strong demand for skilled professionals. While there are a growing number of graduates, some may lack industry-specific skills, requiring additional training or upskilling program. The demand for skilled fashion professionals is high, especially with the growth of e-commerce and the domestic fashion market. However, concerns exist regarding the employability of graduates from less-established institutions.

Investing in robust fashion education that fosters creativity, business acumen, and global awareness will be instrumental in propelling India's fashion industry to the forefront of the global stage.