Kurta Catastrophe: Why big brands like Bestseller struggle in Indian men's ethnic wear

The recent closure of Indifusion, a men's ethnic wear brand acquired by retail giant Bestseller, throws light on the complexities of the Indian ethnic wear market for established western brands. Despite the segment's potential, big brands often struggle to gain a foothold, as exemplified by Bestseller's failed attempt.

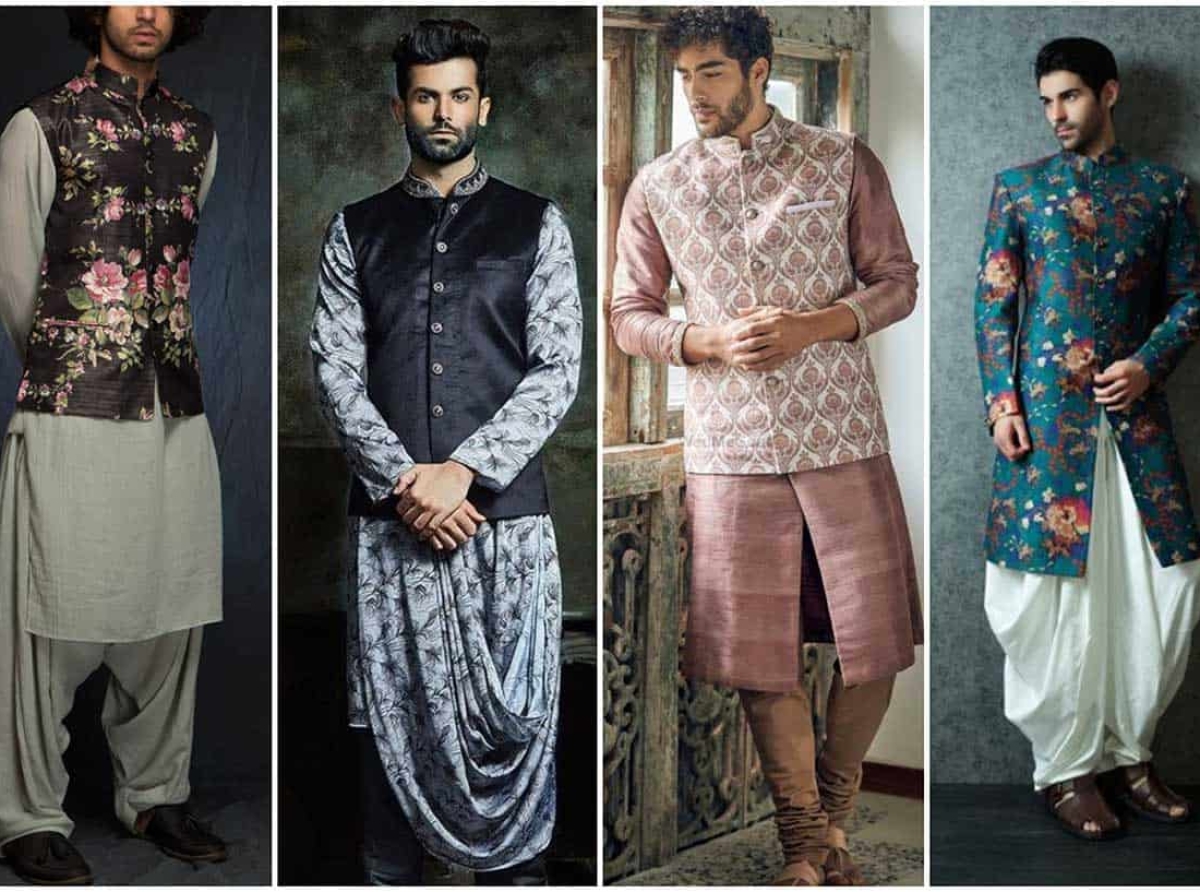

A market steeped in nuance

Bestseller's lack of experience in the Indian ethnic wear segment proved to be a critical factor. Understanding the intricacies of traditional silhouettes, regional variations, and cultural significance of garments is crucial for success. As an expert pointed out, "navigating the nuances of the Indian wear segment" is a challenge for companies accustomed to western styles. Ethnic wear is often occasion-specific, with intricate designs, diverse regional styles, and cultural significance. Big brands, accustomed to standardized western styles, may struggle to cater to this intricate market. This knowledge gap, coupled with the pandemic-induced slowdown in discretionary spending, proved detrimental for Indifusion.

Shifting consumer preferences

The Indian consumer landscape is witnessing a significant shift in apparel choices. While ethnic wear remains dominant in the women's segment with 71 per cent market share, the men's segment is experiencing a move towards ready-to-wear garments and western styles. This is corroborated by Devarajan Iyer, CEO of Lifestyle International, who highlights the "stagnation in the growth of the ethnic wear segment" compared to the "double-digit expansion" of western wear. A Wazir Advisors report too highlights a ‘stagnation’ in the growth of traditional ethnic wear, particularly for men. Consumers are increasingly opting for western or fusion wear for daily wear, reserving ethnic pieces for special occasions. This shift poses a challenge for brands solely focused on traditional men's ethnic wear.

The rise of fusion wear

However, the picture isn't entirely bleak. The market is evolving with the growing popularity of fusion wear, which caters to the evolving needs of the modern Indian consumer. As Pakhi Saxena, Head-Retail at Wazir Advisors, states, consumers are seeking a "blend of cultural influences with comfort and convenience." Fusion wear offers a contemporary interpretation of traditional garments, resonating with the younger demographic and the increasing female workforce who seek a balance between tradition and modern trends.

Direct-to-consumer and the future of menswear

The rise of direct-to-consumer (D2C) brands further disrupts the traditional retail landscape. These brands often cater to niche segments and offer greater customization options, appealing to the increasingly fashion-conscious Indian male consumer. They often leverage social media to build brand awareness and foster a loyal customer base. Big brands, with their traditional retail models, may struggle to compete with this new wave of competitors. This trend, coupled with the growing acceptance of western and fusion wear, poses a challenge to the traditional ethnic wear segment.

Dominance of established players

The Indian ethnic wear market, particularly for women, is dominated by established domestic brands like BIBA, Global Desi, Fabindia, Manyavar among others. These players have a deep understanding of customer preferences, regional variations, and cultural nuances. Competing against this entrenched network can be challenging for big brands lacking the necessary market knowledge and brand loyalty.

Moving forward with innovation and adaptation

Despite the challenges, the Indian menswear market holds immense potential. According to IBEF (Indian Brand Equity Foundation), the market is expected to reach Rs 740 billion ($9.7 billion) by 2024. Brands that can adapt to changing consumer preferences, embrace innovation, and leverage technology like D2C platforms are well-positioned for success. This could involve introducing contemporary cuts and fits to traditional garments, offering a wider variety of fusion wear options, and personalizing the shopping experience.

Here are some potential approaches for big brands:

Partnerships: Collaborate with established ethnic wear brands to gain market insights and leverage their distribution networks.

Fusion focus: Develop fusion wear collections that cater to the evolving needs of the modern Indian man.

Digital transformation: Embrace e-commerce platforms and social media marketing to reach a wider audience and build brand engagement.

Customization: Offer customization options to cater to individual preferences and regional variations.

In conclusion, Bestseller's exit from the Indian men's ethnic wear market serves as a cautionary tale for established brands. Understanding the cultural nuances, adapting to evolving consumer preferences towards western and fusion wear, and embracing technological advancements are key to success in this dynamic market. The future of Indian menswear lies in innovation and brands that can cater to the aspirations of the modern Indian man.