19 January 2024, Mumbai

Groundbreaking "IndiaSize" Program to Dress Nation Perfectly

Get ready for clothes that finally fit! The Ministry of Textiles (MoT) is gearing up to launch IndiaSize. This revolutionary program will ditch foreign sizing standards and tailor garments to the diverse shapes and sizes of Indians.

Say goodbye to the struggles of squeezing into US or UK measurements; IndiaSize promises comfort and confidence in every stitch.

There is much more to it than that

This initiative is much more than just size charts. It's a transformation of the Indian clothing industry.

Designers will finally be empowered to create clothes that flatter local body types, catering to the unique needs of our vast population.

LeapFrog-In alignment with Atma Nirbhar Bharat

Online shopping, a booming trend, will also get a boost. Standardized size charts will take the guesswork out of buying clothes, making online purchases a breeze.

IndiaSize aligns perfectly with the "Make in India" vision. By encouraging domestic production of clothes designed for Indian bodies, the program will strengthen local brands and generate jobs. It's a win-win for consumers, the industry, and the economy.

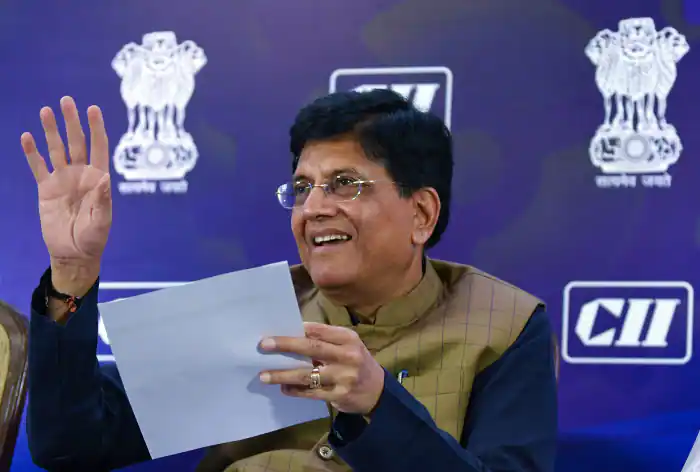

Quotes

"IndiaSize will help us cater to our people better," says Rachna Shah, Secretary of the MoT. And there's more! The Ministry plans to establish a "Centre of Sustainable Fashion Technology," paving the way for a greener, more eco-conscious fashion future.

Hearlds an era of change

The launch of IndiaSize marks a new era in Indian fashion.

It's about celebrating our unique beauty and ensuring everyone feels confident and comfortable in their skin.

So get ready to say hello to clothes that truly fit and a fashion industry that finally understands the Indian body.

5 Key Insights from "Groundbreaking 'IndiaSize' Program":

- Fits Right: Ditches foreign sizes, tailors for Indian bodies.

- More Than Sizes: Transforms clothing industry, empowers designers.

- E-commerce Boost: Makes online shopping easier with standardized charts.

- Make in India: Strengthens local brands, creates jobs.

- Confidently You: Celebrates uniqueness, promotes body positivity.