14 November 2023, Mumbai

A Pivotal Role in Global Textile Production

India's textile industry has long played a crucial role in global textile production, currently standing as the third-largest manufacturer in the world.

The industry's significance extends beyond production, as it serves as a major source of employment, particularly for women. Over 27 million women are employed in the Indian textile industry.

Targeting $250 Billion by 2030

With a strong track record and a focus on innovation, the Indian textile industry is setting ambitious goals for the future.

The industry aims to achieve a milestone of $250 billion in revenue by 2030, demonstrating its commitment to growth and expansion.

Technical Textiles: A Driving Force for Exports

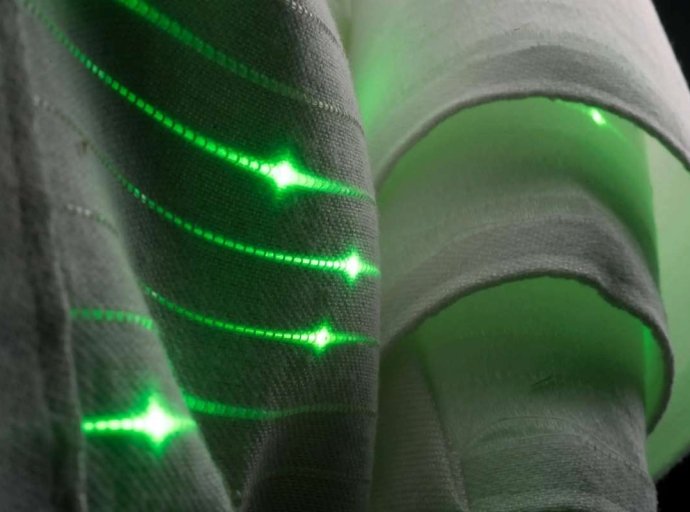

Technical textiles, a relatively new high-tech segment within the industry, hold immense promise for global exports.

These specialized textiles are used in a wide range of applications, from automotive interiors and exteriors to pharmaceutical products. Analysts project that the global technical textiles market will grow at a CAGR of 3.52%, reaching $859 billion by 2028.

Diverse Materials Drive Innovation

The Indian textile industry utilizes a variety of materials, including both natural fiber composites and conventional fibers. Natural fiber composites, derived from plants and animals such as cotton, silk, linen, wool, and hemp, are finding extensive applications in global textile production. These materials offer unique properties and contribute to the industry's innovation and sustainability efforts.

Technical Textiles Poised for Leadership

The technical textiles segment is expected to lead the industry's growth trajectory, with a projected CAGR of 15%.

This growth is being fueled by the increasing demand for high-tech fabrics and the industry's ability to meet these demands through innovation and technological advancements.

Short Message

India's textile industry is a global force, playing a pivotal role in production, employment, and innovation.

With its ambitious goals, focus on technical textiles, and diverse material usage, the industry is poised for continued growth and leadership in the years to come.

5 key insights :

- $250 billion target by 2030

- Driven by innovation and government support

- Sustainable and tech-enabled growth

- Addressing fragmented supply chain

- Upskilling unorganized sector