The Rise of Experiential Fashion: Flagships redefining retail in India's malls

Evolving consumer preferences and a desire for more immersive shopping experiences is changing India’s retail space. A recent Cushman & Wakefield report on leasing activity in India's retail sector for January-March 2025 highlights this shift, particularly focusing on the rise of experiential retail concepts and flagship stores, especially within the fashion category. The report underscores a move beyond traditional retail spaces, with brands prioritizing larger, more engaging environments to connect with consumers. The report delves into key findings of Cushman & Wakefield report, analyzing the impact of this trend on mall leasing, store sizes, and prominent locations.

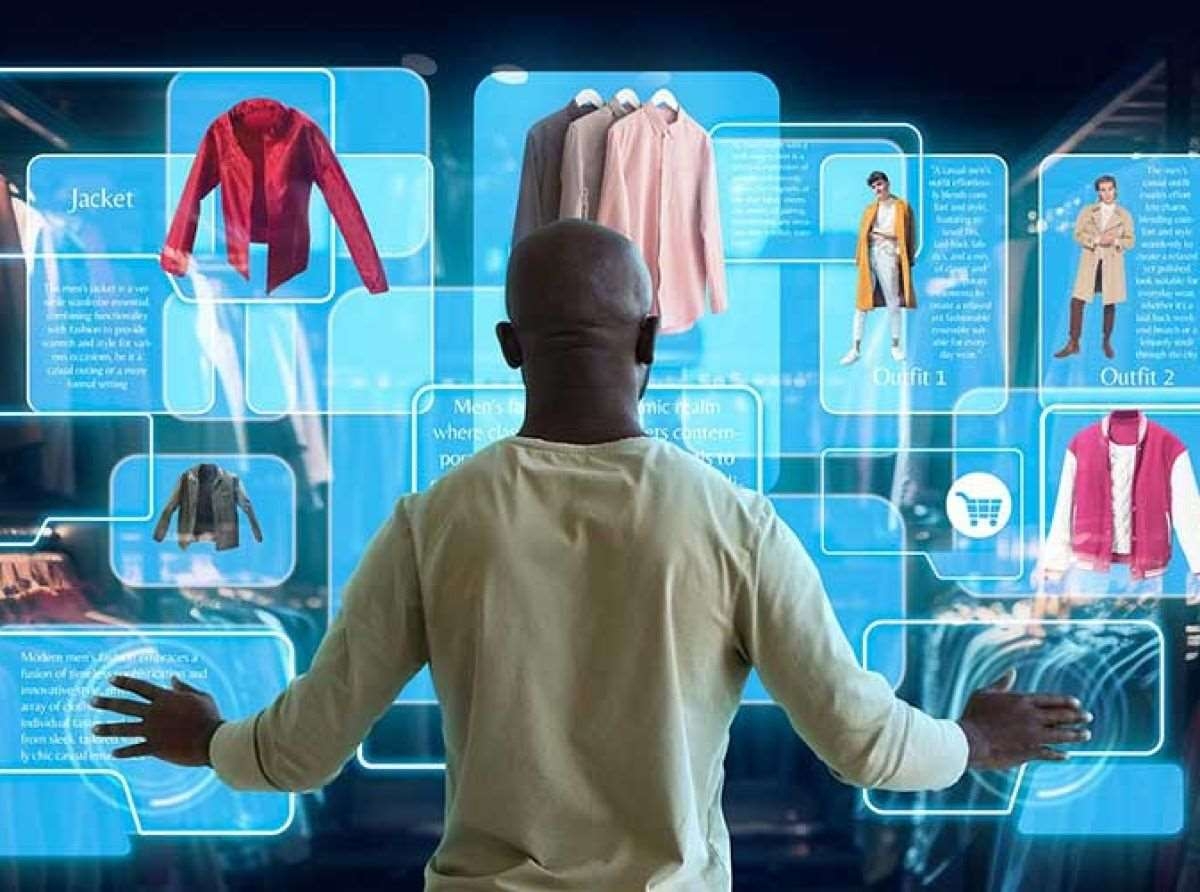

The report indicates a growing trend of fashion brands adopting experiential retail strategies, with flagship stores playing a crucial role. This involves creating retail spaces that go beyond simply showcasing products, focusing instead on providing customers with immersive and engaging brand experiences.

Trends and analysis

Shift towards experiential retail: Fashion brands are increasingly investing in flagship stores that incorporate elements of entertainment, art, technology, and personalized services. This aims to attract and retain customers by offering unique and memorable experiences.

For example, Adidas has invested in large-format stores that showcase the brand's full range of products and incorporate elements of sports and entertainment. Zara, H&M are also moving towards larger stores in prime locations, offering a wider selection and more visually appealing layouts. While not always ‘experiential’, the scale and design contribute to a more immersive brand experience. High-end fashion brands like Louis Vuitton, Gucci, and Dior are known for their opulent flagship stores in major Indian cities. These stores are designed to showcase the brand's heritage and craftsmanship, offering exclusive products and personalized service.

Join our group

Impact on mall leasing: The demand for larger retail spaces to accommodate these flagships is influencing mall leasing trends. Malls are adapting by allocating more space to experiential retail concepts, often at the expense of traditional retail formats.

Growth in leasing: The report shows leasing activity in the retail sector rose 55 per cent to cross 2.4 million sq. ft. (MSF) in the January-March quarter this year across the top eight cities. Fashion and F&B segments led space take-up in main streets across the top-8 cities with 0.80 MSF of leasing volume. In malls, entertainment and fashion were the biggest space consumers.

The report also highlights a significant difference in the average size of flagship stores compared to traditional retail outlets. Flagship stores typically range from 5,000 to 20,000+ sq. ft, depending on the brand and its experiential concept. Some can exceed this, particularly for international luxury brands. Traditional outlets usually range from 1,000 to 3,000 sq. ft. This shows a substantial increase in space requirements for retailers adopting the flagship store model.

The Cushman & Wakefield report indicates heightened interest in premium high street locations in Delhi-NCR, Mumbai, Bengaluru, and Hyderabad.

Delhi-NCR: Connaught Place witnessed a 14 per cent year-on-year increase in retail space rentals, indicating strong demand for premium locations. Khan Market one of the costliest high-street locations globally, also saw rental increases.

Mumbai: The retail market saw leasing volumes of 0.58 MSF in Q1-25. Malls accounted for 55 per cent in overall leasing, almost 3.5 y-o-y growth while main street leasing comprised the remaining. Superior grade malls comprised 90 per cent share. The fashion segment led with 39 per cent share. For example, Nike has established flagship stores in Mumbai that offers personalized shopping experiences, customization options, and interactive displays. These stores often host events and workshops, transforming the retail space into a community hub.

Other cities: Bengaluru and Hyderabad also saw growth in experiential retail, with malls and high streets adapting to accommodate larger format stores.

Thus the Cushman & Wakefield report confirms that India's retail sector, particularly the fashion segment, is gradually shifting adapting experiential retail and larger-format flagship stores. This trend is reshaping mall leasing, driving demand for larger spaces, and prompting malls to evolve into destinations that offer more than just shopping.

The growth in cities like Delhi-NCR and Mumbai, along with the strategies of leading fashion brands, highlights the increasing importance of creating immersive brand experiences to engage the modern Indian consumer. This trend is expected to continue, with more brands investing in flagship stores and experiential concepts in the coming years.

Latest Publications