06 December 2023, Mumbai

WHY India

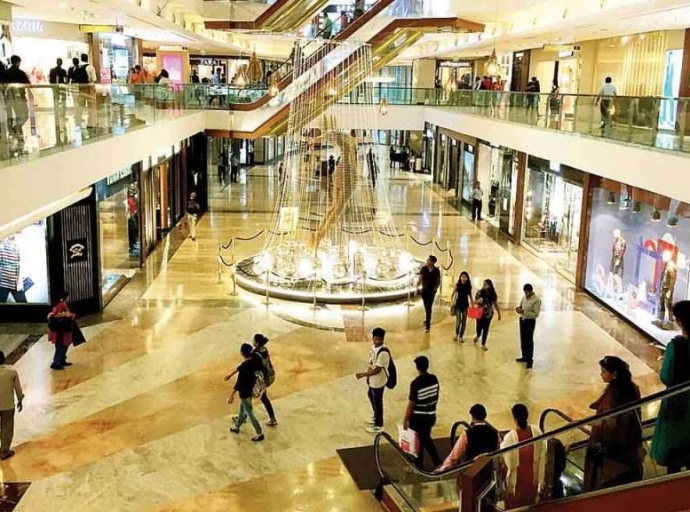

Facing rising costs and a post-pandemic world, Indian retailers are going big, not home. They're expanding their stores by 30–50%, betting on immersive in-store experiences to win over customers. Forget just getting you in the door; it's all about keeping you there and making that purchase.

Think interactive displays, personalized recommendations, and even AR/VR magic. Physical stores are no longer just places to buy stuff; they're destinations for discovery and delight. And with India's growing economy, people are willing to spend more on those good vibes.

Quotes

Pankaj Renjhen, a retail expert, puts it this way: "Stores are about engagement, not just products." Brands are listening. They're adding cafes, salons, and even workshops to their massive new spaces.

Multiple data-points

The numbers tell the story: 3.16 million sq. ft. of retail space leased in just the first half of 2023! That's a confidence boost for the industry and a sign that shoppers are craving something special.

And what's special? It's not just size. The share of medium-sized stores (2,000-5,000 sq. ft.) is booming, growing from 19% to 21%. Even larger stores are joining the party.

Prognosis

Indian retail is changing its tune. It's no longer a price war; it's an experienced race. And the stores that win will be the ones that can make you feel like you're not just shopping, you're having an adventure.

So, get ready, India. The future of retail is here, and it's more exciting (and maybe a little bigger) than ever before.

5 key insights :

-

Experiences over price: Indian retail is shifting from price wars to immersive experiences.

-

Bigger stores, bigger bets: Retailers are expanding stores by 30-50%, betting on in-store experiences.

-

Engagement, not just products: Stores are becoming destinations for discovery and delight, not just purchases.

-

Customers crave special: Growing economy fuels demand for unique retail experiences.

-

Retail's future is here: India embraces an exciting and immersive retail landscape.