04 March 2022, Mumbai:

Tiruppur Exporters’ Association (TEA) has urged the Union Finance Minister to help the MSME units with liquidity. MSMEs in India are facing liquidity issues due to an unprecedented increase in raw material and cotton yarn prices in the last 15 months, says TEA.

Around 95 percent of units in the garment exports sector come under MSMEs and they need a fresh infusion of funds to revive.

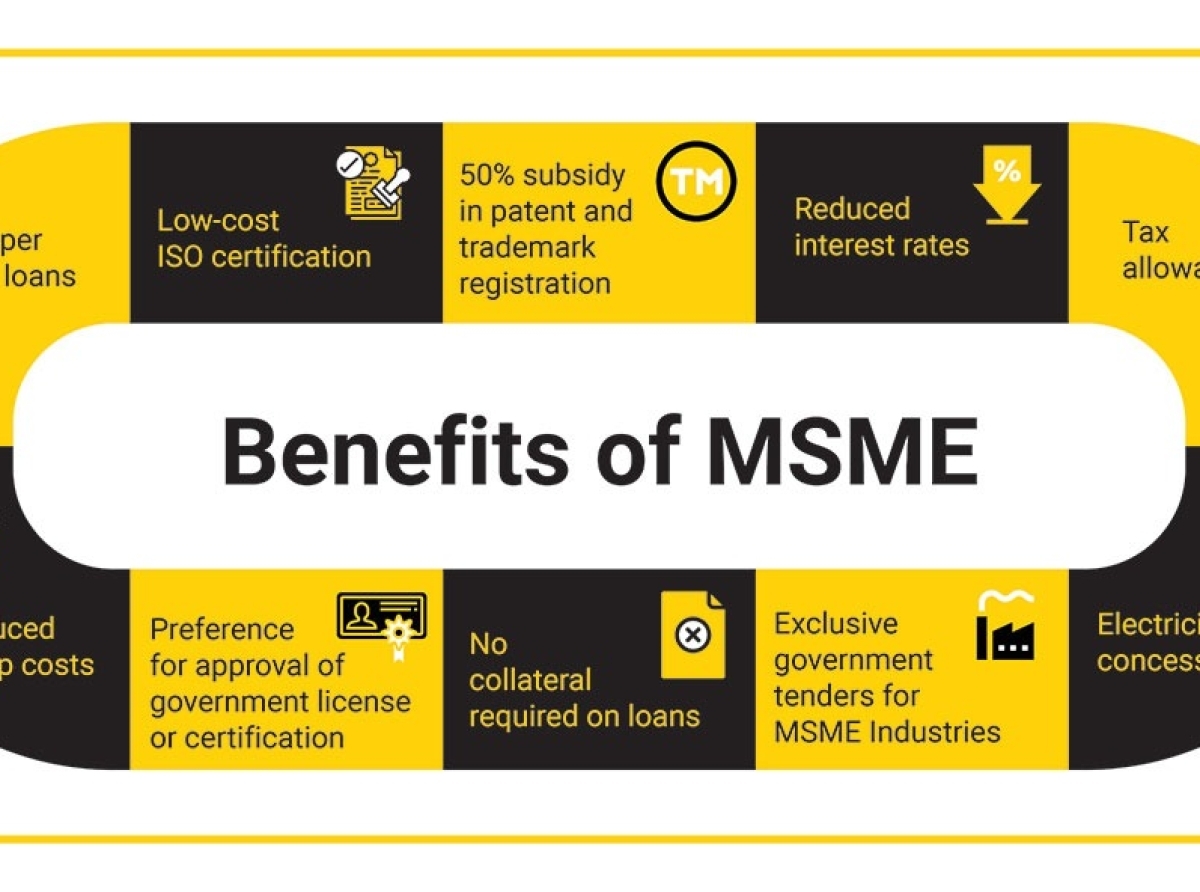

The government should introduce a new scheme similar to ECLGS and permit MSMEs to avail of additional credit facility of 10 percent to 20 percent of the existing limit, it adds TEA also urged the government to extend the Interest Equalisation Scheme on Pre and Post Shipment Rupee Export Credit that expired on September 30, 202 with retrospective effect (October 1, 2021).

ALSO READ: TEA advocates for a two-year extension of the IES on pre-and post-shipment rupee export credit

The Coimbatore District Small Industries’ Association sought new loan schemes for start-ups and extension of collateral-free automatic loans for MSMEs to meet operational liabilities and restart businesses.

It also insisted on the removal of high credit scores and security collaterals, which many small-time borrowers are unable to meet. Coimbatore and Tiruppur District Tiny and Micro Enterprises’ Association urged for a reduction in GST for job working engineering units to 5 percent from 12 percent.

RELATED ARTICLE: Tirupur exporters meet FM, urging to help SMEs

Join our community on Linkedin