The India Effect: Why global fashion houses are rewriting their playbooks

01 July, Mumbai 2025

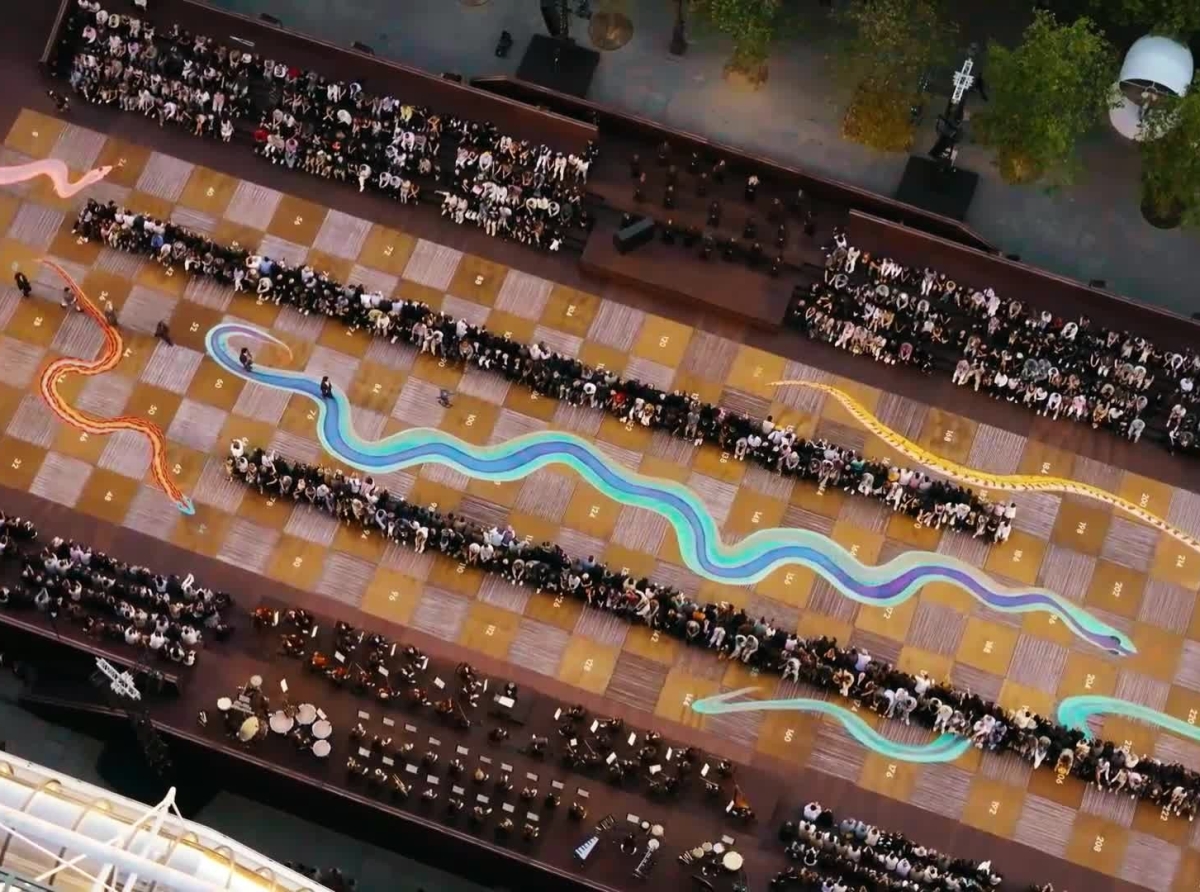

When Pharrell Williams’ Louis Vuitton Spring 2026 menswear show unveiled a dazzling, India-inspired collection in the heart of Paris, it wasn’t just a nod to cultural aesthetics—it was a turning point. From a Snakes and Ladders-themed runway conceptualized by Indian architect Bijoy Jain, to a soul-stirring score co-created with AR Rahman, and a collection steeped in Indian craftsmanship and symbolism, LV’s show reverberated with respect, intention, and strategy.

The unspoken but unmistakable message: India is no longer the distant muse or the luxury world’s afterthought. It is the moment—and the future.

A long-awaited reckoning

For years, India’s storied traditions in craftsmanship and design drove the aesthetic engines of luxury maisons. Yet, the country itself remained under-addressed—seen more often as a workshop than a partner, more muse than market. That era is ending. So what changed? The reasons are many but the important ones are: economic growth, digital adoption, demographic dividends and a cultural awakening. Indian consumers are no longer silent admirers of Western luxury. They’re informed, assertive, and unwilling to be reduced to footnotes.

India’s economy is the fastest-growing among major nations, and its rising affluence is palpable. By 2028, the number of ultra-high-net-worth individuals is expected to rise by 50 per cent. But the real disruption lies with Gen Z—a 377-million-strong force representing 40 per cent of urban buyers and nearly half of all spending. These digital natives are global citizens with local pride. They know when their heritage is being co-opted, and they expect acknowledgment.

A market that’s no longer waiting in the wings

India’s luxury market, currently estimated at $17 billion, is forecasted to reach $85 billion by 2030. Some optimistic forecasts even place the figure higher that $200 billion. And this rise is not confined to Mumbai or Delhi. Tier I, II cities—Lucknow, Surat, Kochi—are fast becoming hotbeds of aspirational luxury. Jewelery, long tied to India’s wedding culture and religious customs, remains a core sector. But fashion and accessories are catching up, driven by younger consumers blending tradition with streetwear and luxury silhouettes. Cosmetics, fragrances, and even pre-owned luxury are gaining ground, signaling a broadening of what "luxury" means in the Indian context.

Luxury cars are also driving deeper into Indian roads—not just as vehicles, but as status statements. From Gucci belts to BMW grills, the Indian consumer is evolving from conspicuous consumption to what some are calling “quiet luxury”—understated, yet unmistakably premium.

Table: India luxury market snapshot

|

Segment |

Revenue 2023 (approx.) |

Projected growth (CAGR 2024-29) |

Key trends |

|

Overall Luxury Market |

$7.74 billion |

Over 13% (to $85B by 2030) |

Digitalization, pre-owned luxury, sustainability, AI personalization |

|

Fashion & Accessories |

11% of total market |

Significant |

Increased demand from younger generations, cultural integration |

|

Jewelry |

Over 10% of total market |

Strong |

Traditional and modern designs, tied to cultural events |

|

Prestige Cosmetics & Fragrances |

Growing |

Significant |

Rise of global beauty brands, clean beauty, sustainable practices |

|

Luxury Automobiles |

Growing |

Steady |

Increased purchasing power, status symbol |

A tale of two brands: Louis Vuitton’s triumph, Prada’s trouble

The Louis Vuitton show was lauded not just for its aesthetics, but its integrity. Pharrell’s India trip—traversing New Delhi, Mumbai, and Jodhpur—was more than symbolic. It was research with reverence. He sought out artisans, studied Indian dandyism, and grounded the collection in lived experience. Every motif had context; every collaborator, like Bijoy Jain and Rahman, received due credit. The result: a show that resonated not just with the fashion elite, but with Indians watching from across the globe—many for the first time feeling truly seen.

Contrast this with Prada’s recent stumble. The Italian house drew widespread criticism for selling a traditional Indian Kolhapuri chappal as a “luxury leather sandal,” devoid of cultural attribution. For Indian consumers, it wasn’t just an oversight—it was a glaring act of erasure. The backlash was swift, vocal, and global. The message was clear: inspiration without attribution is no longer acceptable.

Cultural capital meets consumer clout

Brands like Dior have begun to understand this. Its collaboration with the Chanakya School of Craft in Mumbai signaled not just a celebration of Indian embroidery and textile arts, but a recognition of the community behind them. From mirror work to zari, from Chanderi silks to Madhubani prints, Indian craftsmanship is no longer a hidden ingredient—it’s the centerpiece.

But appreciation must be active. Today's Indian buyer doesn’t want borrowed symbols—they want empowered partnerships. They want to see Indian creators credited, Indian locations celebrated, and Indian stories told.

The future, from selling to co-creating

To succeed in India, luxury brands need more than a flagship store in Mumbai’s Palladium Mall or in Delhi’s Emporio. They need to embed themselves in the culture—not to sell, but to build.

That means: Better understanding of Indian rituals, from Diwali to destination weddings; collaborating with local designers, artists, and craftspeople; tailoring digital and in-store experiences to regional nuances; acknowledging inspiration openly and compensating accordingly; engaging with Indian voices not as tokens, but as architects of the brand story. In fact, digital-first platforms, especially in Tier II, III cities, are already making this easier. WhatsApp boutiques, AR-enabled try-ons, and Instagram shopping—these are not frills in India. They’re essentials.

To sum up, the Louis Vuitton show was more than a collection—it was a conversation: about India’s place in the global luxury ecosystem; about what it means to be inspired by a culture versus partnering with it and bout how prestige and inclusivity are no longer opposites. Therefore, as global luxury focuses toward its next era, India stands not as a footnote, but as a co-author. And this time, it’s writing in bold.