The Consumption Conundrum: Can India's Growth ride on spending alone?

A single, vibrant strand is currently pulling the Indian economy forward: consumption. From Delhi’s bustling bazaars to the digital storefronts accessed from remote villages, the rise in consumer spending is undeniably driving growth. But the moot point is: can this single strand bear the weight of India's economic aspirations, or will it begin to fray?

The fundamental principle is that sustained growth requires a harmonious balance between supply and demand. With its powerful multiplier effect, investment acts as the loom that weaves these elements together. This is where the contrasting narratives of India and China offer valuable lessons.

The China story: Investment as the warp and weft

China's remarkable rise is a testament to the strength of investment as the warp and weft of economic development. From the 1970s, China consistently prioritized investment, particularly in infrastructure and manufacturing, creating a robust foundation for export-led growth. This strategy led to rapid industrialization, job creation, and a rise in national prosperity.

China has recorded consistently high investment rates. In fact, in 1992, China's investment share of GDP stood at 39.1 per cent, compared to India's 27.4 per cent.

It adopted a policy of state-led investments in critical sectors. By 2023, China's investment rate reached 41.3 per cent, while India's lagged at 30.8 per cent. The relentless focus on export-oriented manufacturing bore results and the massive, transformative infrastructure development are an example for others to follow.

India's consumption canvas

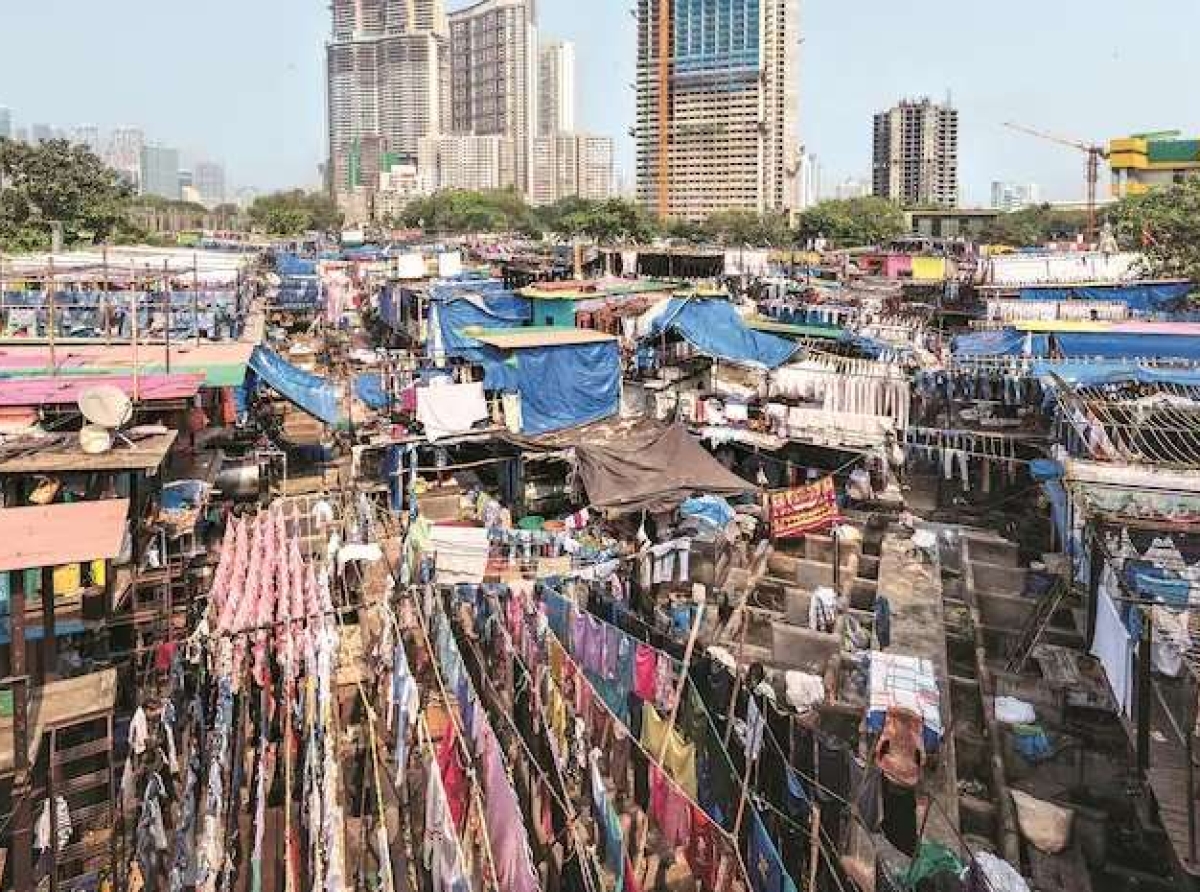

In contrast, India's recent growth story is based on domestic consumption. This is particularly evident in the growing fashion and apparel sector, a key driver of India's consumption-led expansion.

The India fashion retail market size was estimated at $58.16 billion in 2023, and is projected to reach $125.31 billion by 2030, with a CAGR of 12.65 per cent highlights a Blueweave Consulting study. Companies like Reliance Retail, Trent and Aditya Birla Fashion and Retail Limited are capitalizing on this growth, expanding their footprints and catering to the evolving needs of Indian consumers.

As per Wazir Advisors, "The per capita expenditure on apparel is expected to reach Rs 6,400 by 2023, from Rs 3,900 in 2018. Therefore, the total Indian apparel consumption expenditure is expected to grow to Rs 9.35 lakh crores by 2023."

This increase is due to rising disposable incomes, rapid urbanization, and the increasing influence of global fashion trends, which get a boost from social media. The sector contributes nearly 2 per cent of India's GDP and accounts for 14 per cent of industrial production, highlights Wazir Advisors’ study.

The consumption-led growth scenario throws up numerous challenges. It results in a weaker multiplier effect compared to investment. It has the potential for increasing income inequality, leaving many behind and a dependence on potentially volatile sources of demand. It results in a persistent trade deficit and stagnation of public and private investment.

Table: Comparative analysis and the contrasting picture

|

Feature |

China |

India |

|

Growth Model |

Investment-Driven |

Consumption-Driven |

|

Investment Rate |

High (40%+ of GDP) |

Relatively Low (around 30% of GDP) |

|

Infrastructure |

Extensive, Advanced |

Developing, with Gaps |

|

Manufacturing |

Strong, Export-Oriented |

Developing, with Potential |

|

Income Inequality |

Significant, Addressed Through Growth |

Widening, a Growing Concern |

|

Government Role |

Active, Interventionist |

Relatively Passive in Investment |

|

Fashion Retail Growth |

Growing, but less of a GDP driver. |

Very Strong GDP driver. |

|

Investment rates over time |

||

|

Year |

India (% of GDP) |

China (% of GDP) |

|

1992 |

27.4 |

39.1 |

|

2007 |

35.8 |

N/A |

|

2013 |

31.3 |

44.5 |

|

2023 |

30.8 |

41.3 |

India's future depends on its ability to weave a balanced economic fabric. While consumption, particularly in sectors like fashion, offers a vibrant hue, it cannot be the sole sustaining strand.

By prioritizing investment, fostering a conducive business environment, and addressing income inequality, India can strengthen its economy. The government must act as a skilled weaver, guiding the process and ensuring that all threads contribute to a strong, resilient, and prosperous future.