09 April 2022, Mumbai:

Higher raw material cost is likely to impact textile demand during Q1FY23 on a quarter-on-quarter basis.

As per India Ratings and Research (Ind-Ra), sustained rub-off impact from high man-made fibre (MMF) prices amid new arrivals will keep domestic cotton prices to remain at the current high levels during Q1FY23.

ALSO READ TIRUPPUR TRADERS EXPECT COTTON YARN PRICES TO RISE POST FESTIVE SEASON

ShradhaSaraogi, Senior Analyst, India Ratings and Research, says,Ind-Ra also expects inventory levels to decline by the end of the current cotton season due to a lower opening stock and slightly higher consumption.

Similarly, the domestic stocks-to-use ratio could decline in the new cotton season.

Furthermore, Ind-Ra expects cotton yarn and spun yarn prices to continue to rise due to higher demand from downstream players as well as export markets.

RELATED NEWS Space Rocketing Cotton and Cotton Yarn prices – Representations pending for Government action

According to the rating agency, MMF products witnessed a drastic rise in prices in February 2022 due to an increase in crude oil prices.

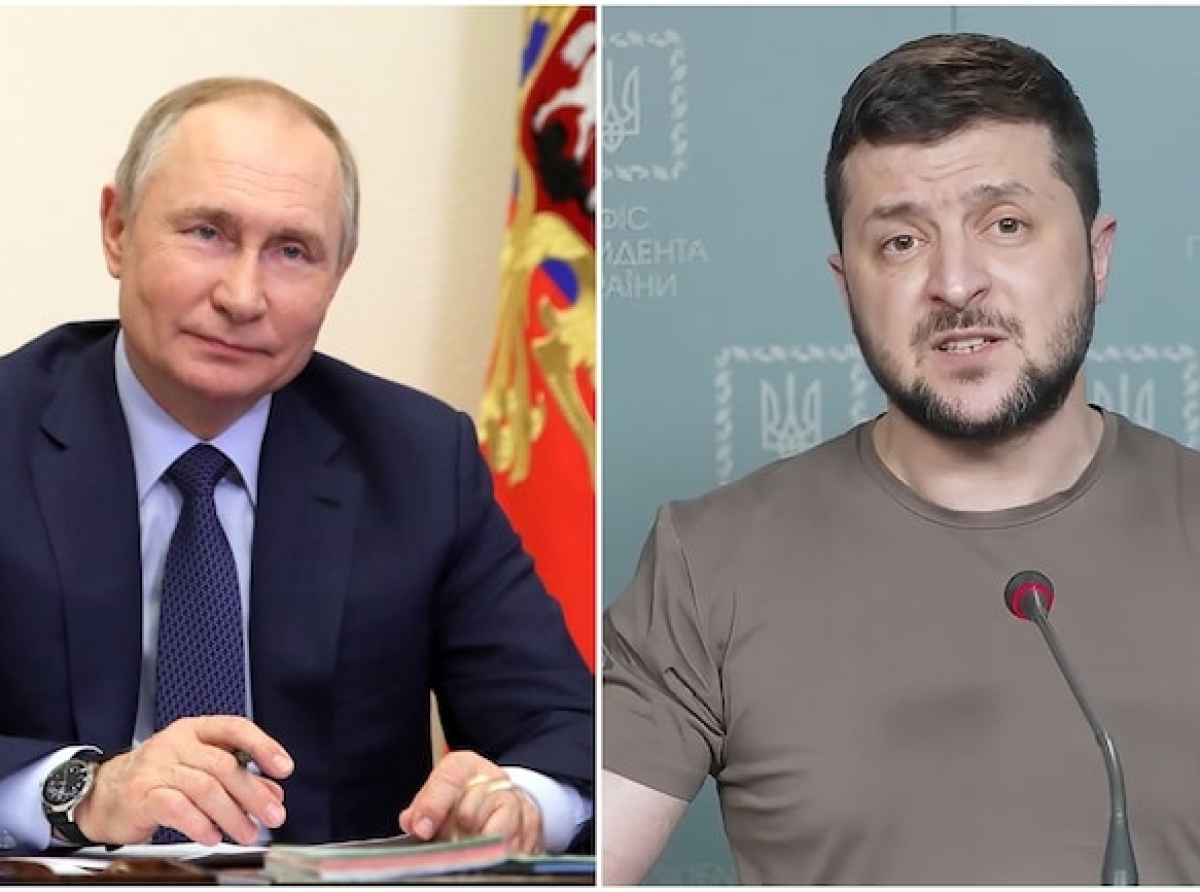

Ind-Ra expects the prices to increase further owing to the US ban on Russian oil and US tie-ups in Europe, along with a rise in raw material prices, led by the ongoing geopolitical issues and increased cotton prices.

Join our community discussion on Virtual Fashion.