Wazir Advisors: EBITDA recorded robust growth during 9 months, FY'22

16 March 2022, Mumbai:

The latest textile index of 10 companies done by Wazir Advisors show sales and EBITDA recorded a tremendous growth during the nine months in fiscal 22.

The 10 reviewed companies were: Welspun India, Vardhaman Textile, Arvind Ltd, Trident Group, KPR Mills, Indo Count India, RSWM, Filatex India., Nahar Spinning Mills, and Indorama Indi. Sales grow by 30%.

The Wazir Textile Index shows overall sales of the 10 companies under review grew 30 percent compared to 9M FY20.

ALSO READ: Minister of State for Textiles: Potential to become the 2nd largest manufacturer of textile products

Consolidated sales grew 14 percent to Rs 38,094crore as against Rs 29,195 crore in 9MFY20.

EBITDA margins improved almost 75 percent during the fiscal year 2022 compared to the EBITDA in 9M FY20.

Average EBIDTA margins of these companies grew 5 percent, 17 percent, and 20 percent CAGR respectively from 2020-to 2022.

Raw material and other costs decline In terms of expenses, the average raw material costs of these companies decreased 4.0 percentage points to form 60 percent of overall sales during the period.

Their average employee costs decreased 1.0 sales percentage points during the nine-month period compared to 9MFY20.

Other expenses decreased by 1.0 percentage points during the period compared to 9MFY20.

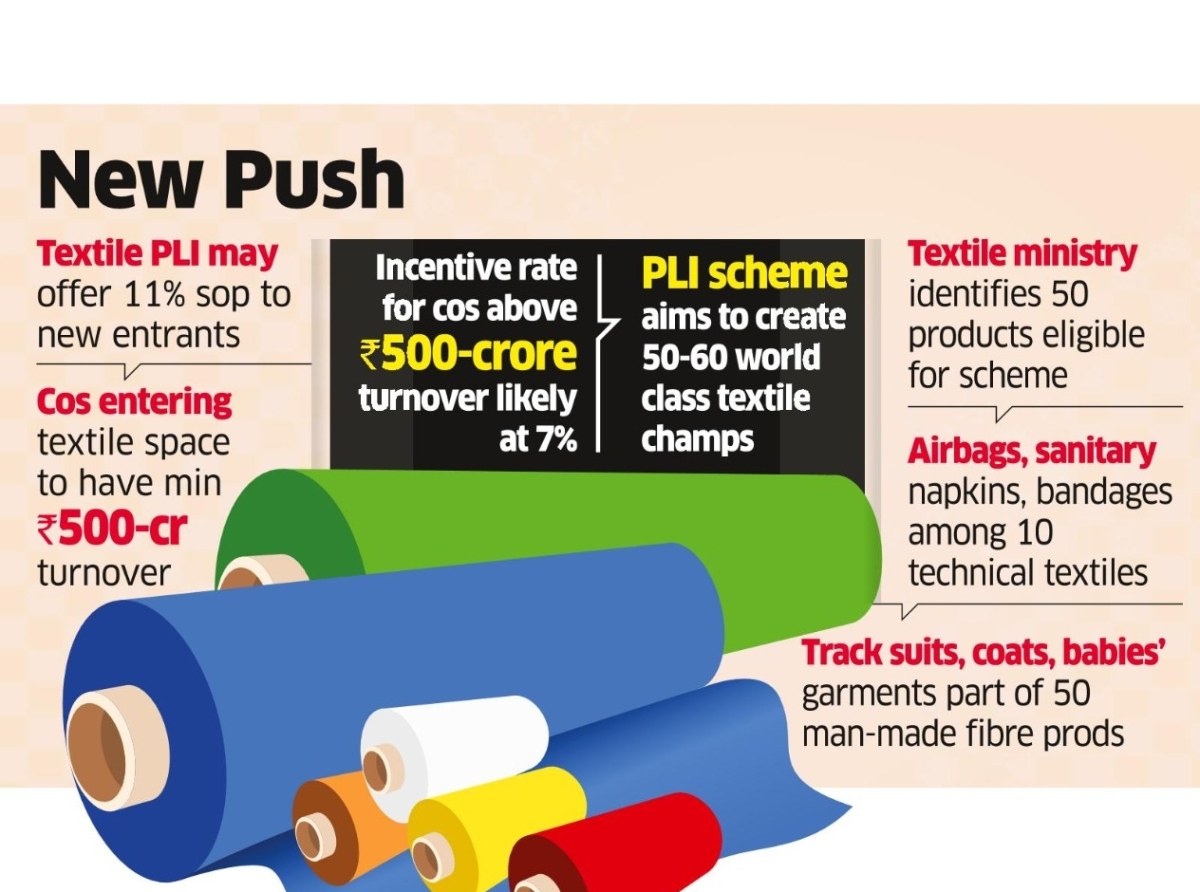

ALSO READ: Ministry of Textile: Gets many applications for PLI in Man-Made Fibres, Techtex

Apparel outpaces textile growth- The consolidated earnings of these companies have seen significant recovery since FY21.

The Index of Industrial Production Index (IIP) recovered to pre-COVID levels.

While IIP for the apparel category increased by 78 percent during 9MFY22 as compared to the corresponding period in FY, the Average Wholesale Price Index (WPI) for apparel increased 3.5 percent compared to textiles which went up 12 percent each in 9M FY22 as compared to 9MFY20.

11% growth in textile and apparel exports Textile and apparel exports grew at 11 percent CAGR during 9M FY22 since 9M FY20.

Export of fibers recorded the highest growth of 58 percent followed by 36 percent growth in yarn exports. In Q3 FY22, fiber exports grew at 50 percent CAGR as export of cotton increased due to the US ban on cotton purchases from China.

India’s textile exports to the EU declined from 23 percent to 14 cents whereas exports to Bangladesh increased to 11 percent from 7 percent seen during the same period last year.

ALSO READ: Piyush Goyal: Next Textile sector Unicorn should come from the 'ICT'

Imports decline 3% Overall textile and apparel imports by these ten companies declined 3 percent during 9M FY22 as compared to 9M FY20.

Import of filament yarn grew 24 percent CAGR since 9M FY20. However, the import of fiber and home textiles declined during the period as compared to 9M FY20.

China dominates T&A imports from India China continues to be the largest importer of textiles and apparel from India with a share of 41 percent in 9M FY22.

However, the country’s import share declined 4.0 percentage points from the corresponding period of 9M FY21.

EU’s import of share of textiles and apparel from India also declined 6 percent in 9MFY22 compared to 9M FY20 in 9M FY22.

Imports were hit by multiple nationwide lockdowns and restricted movements.

However, in recent times EU-27 countries have been increasing imports from countries like China, Bangladesh, Turkey, India, and Pakistan.

RELATED ARTICLE Commerce Min Proposes Sops To Textile Exporters For EU Mkts

Join our community on Linkedin