21st September 2021, Mumbai:

With the pandemic and recurrent lockdowns re-emphasizing the importance of outdoor vacations, demand for resort wear in India has surged in the last year and half. Many international brands like Fendi, Louis Vuitton, Dior and Versace launched their resort wear collections earlier this year, as per a Vogue International report. Though the segment in India has few established players like Savio Jon, James Ferreira and Wendell Rodricks, it is nonetheless a booming market.

Poised for big role in ready-to-wear market

The segment is poised to play an important role in India’s ready to wear market in the coming decade, says Narresh Kukreja, Creative Director, Shivan & Naresh, a homegrown resort label. No longer a niche category, it is likely to become an inevitable offering for long-term survival of Indian brands in future, he adds. Brand Studio Verandah, which opened its first store in Goa, received a huge number of orders during the three-month gap between the first and second waves. The designers saw a huge pent-up demand for resort wear owing to customers’ long-pending vacations, adds Reby J Kumar, Guapa Resort Wear.

There was also a huge demand for kaftans in all variations including co-ord sets, relaxed shirts, swimwear, kimonos and maxi dresses. Resort wear served as transitional dressing style during the lockdowns, says Anjali Patel Mehta, Studio Verandah. Now, it has become a part of people’s everyday dressing, she adds. The segment has also moved from niche to mainstream audience. The pandemic gave resort wear seasonless look with consumers’ changing lifestyles accelerating this shift, opines Kukreja.

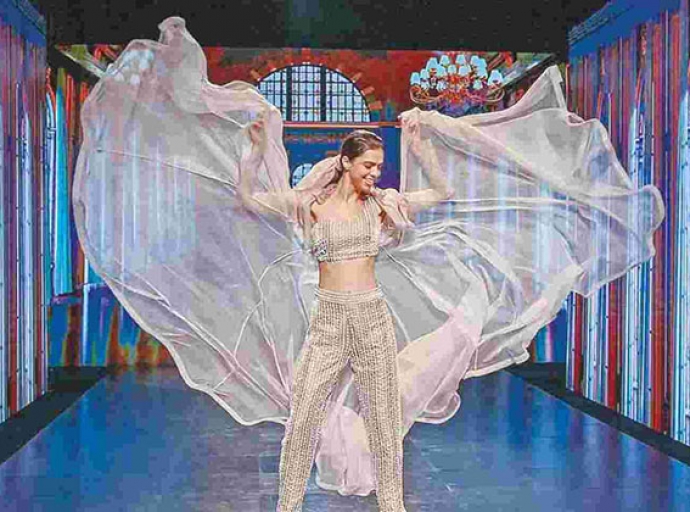

Bridal wear overlap

Resort wear in India may not rake in as much profit as bridal wear. However, the gap in revenues generated by both segments continues to narrow as sales overlap. Resort wear has influenced many Indian bridal wear designers to expand to kaftans, says Patel. Consumers are also being experimental with their wedding wardrobes and mixing relaxed styles with Indian jewelry. They are likely to further shift to kaftans and statement shirt-and-pant sets with their traditional outfits, adds Patel. Indeed, the growing popularity of easier and fuss-free dressing is likely to surge demand for resortwear in India over the next few months.

Return to homepage