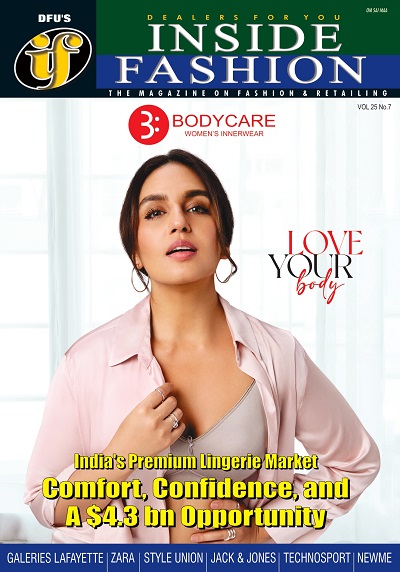

Gaining from a mark shift to online sales during the pandemic, Nykaa aims to increase its future IPO value to $4.5 billion from the earlier $3 billion.

Nykaa will retain the size of the IPO between $500 and $700 million. The increase in value is led by a spurt in the e-commerce platform’s revenues and profit due to COVID-19 led disruptions. As per reports, the IPO will be released by 2021-end or early 2022.

Nykaa has appointed Kotak Mahindra Capital and Morgan Stanley as managers for it’s the IPO. Founded in 2012, Nykaa is India’s top women-centric online marketplace with around 15 million registered users and caters to 1.5 million orders a month.

The platform has been able to carve out a niche for itself through excessive focus on the beauty and personal care segment, which differentiates it from horizontal e-commerce companies like Flipkart and Amazon.

Nykaa expanded its presence to offline retail in 2015 and has a network of 80 stores selling luxury brands such as Tom Ford, Jo Malone London, Dior, and Givenchy.

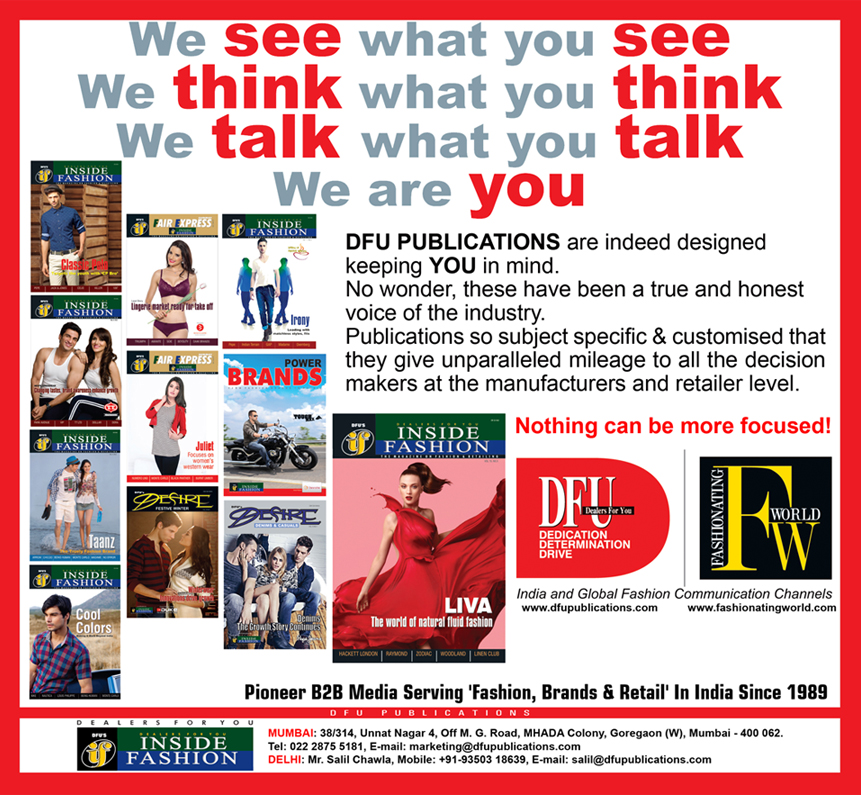

Dear Reader, we at DFU Publications are committed to providing the latest news updates on trade development and insights, to keep our readers informed. Stay tuned. Subscribe to our newsletter.

DAILY NEWS:

- Flipkart, an Indian e-commerce company, collaborates with PUMA on the ‘1DER' line, which features batsman KL Rahul

- Consumers will determine growth of sustainable fashion e-comm in India

- Myntra to offer 1 mn styles from about 7,000 brands at the 'Big Fashion Festival'

- Maharashtra government honors VIP as 'Best Innerwear Brand' for 2021-22

- Nike strengthens retail presences with new store at DLF Mall of India,Noida