The question, ‘Do we really need a T-shirt or underwear in 15 minutes?’ once posed with a hint of skepticism, is now at the heart of a growing retail transformation in India. As quick commerce (Q-commerce) platforms rapidly expand their horizons beyond daily groceries, fashion, surprisingly, is emerging as a significant growth frontier.

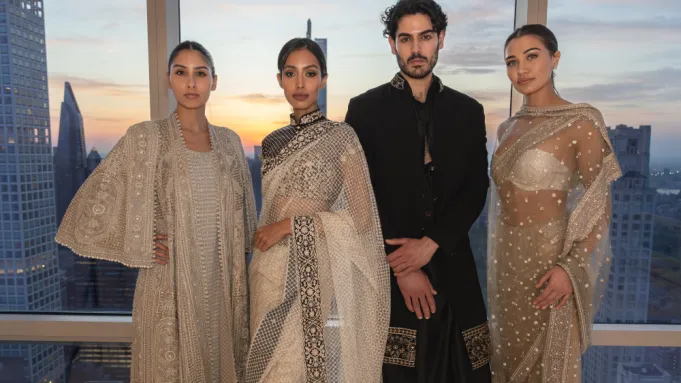

Fashion Guru

From essential innerwear and basic T-shirts to trendy loungewear, apparel has found an potent new sales channel – not through traditional retail fanfare, but via the promise of 15-minute delivery on popular apps.

This isn't merely a supply chain adjustment; it's a reflection of a profound psychological shift in consumer behaviour where immediacy has become a non-negotiable expectation. The Indian online apparel market, a substantial sector valued at approximately Rs 1.72 lakh crore in 2024 as per Statista, is witnessing this rapid evolution firsthand.

DFU Profile

"Apparel was never considered a quick-buy category. But today, impulse is the driving force of millennial and Gen-Z shopping behaviour," notes an Apparel Strategy Lead at a prominent q-commerce firm. This sentiment is backed by statistics, with some Qcommerce platforms reporting 7X growth in apparel orders in the last 18 months alone.

Table 1: Q-commerce apparel trends in India (2024-25)

|

Metric

|

Value

|

YoY growth

|

|

Apparel Share of Q-Commerce GMV

|

6.80%

|

↑ 180%

|

|

Top Apparel Items Ordered

|

Innerwear, T-shirts, Athleisure, Loungewear, Everyday Basics

|

---

|

|

Average Order Value (AOV) for Apparel

|

₹684

|

↑ 14%

|

|

Cities Leading Q-Commerce Fashion

|

Bengaluru, Mumbai, Delhi NCR

|

---

|

|

Average Conversion Time (Search to Order)

|

<3 minutes

|

↓ 35% (faster)

|

(Source: Compiled from industry reports and internal analytics from major q-commerce players, 2025).

Join our group

The anatomy of the 15-minute apparel order

What's leading to this unprecedented demand for instant fashion? Experts point to a combination of ‘Speed + Need + Simplicity’. For example last-minute travel revealing a missing pair of socks or a crucial T-shirt. Then there is the sudden realization at dawn about the lack of clean gym shorts for a workout.

Or a social spontaneity like impromptu weekend plans demanding a quick wardrobe refresh. And then there is the aspect of comfort economy. With more people working from home or prioritizing comfort, the impulse to buy cozy daily wear is high.

"We’ve seen customers ordering innerwear at 10 PM before a red-eye flight or a new tee minutes before a date,” shares a Category Head for Fashion at a leading q-commerce platform. “This isn’t a gimmick—it’s filling a real, unmet convenience gap.”

Join our community

Apparel brands riding the Q-commerce wave

The synergy between apparel brands and q-commerce platforms is already yielding impressive results. For example, A major Q-commerce player partnered a popular men’s innerwear brand in 2023 to explore demand for essentials via ultra-fast delivery. The outcomes within six months were telling: sales grew 240 per cent in two major metros, with 70 per cent orders being placed post-8 PM. The demand was so high it compelled the platform to triple its warehouse allocation for the brand to prevent stock-outs. No wonder the sale director at the innerwear brand saw Q-commerce as perfect for their. As per him, underwear is often an afterthought—until it’s urgently needed. That’s when they win.

Visit for more

Reshaping the apparel supply chain

Delivering apparel in minutes requires a fundamental re-engineering of the traditional apparel supply chain, which is typically geared for longer lead times and seasonal cycles.

- Hyperlocal warehousing (dark stores): A dense network of urban micro-fulfillment centers (dark stores) stocking a curated, high-demand apparel inventory is essential.

- Intelligent inventory management: AI-driven analytics are vital for forecasting hyperlocal demand for diverse SKUs (sizes, colors) and optimizing stock. Solutions include zoning inventory based on pin-code demand patterns, partnering with brands for pre-packed "bestseller bundles," and curating a focused catalog to ensure high SKU velocity.

- Agile logistics: A robust, algorithm-optimized delivery fleet forms the backbone of the rapid delivery promise.

However, this speed and agility come at a price, differing from traditional e-commerce

Table: Comparative supply chain costs (per apparel order)

|

Cost Component

|

Traditional E-Commerce

|

Q-Commerce (Urban Zones)

|

|

Picking & Packing

|

₹12

|

₹18

|

|

Last-Mile Fulfillment

|

₹18

|

₹35–₹50

|

|

Return Handling (avg.)

|

₹25

|

₹10–₹15 (often lower due to category/price point)

|

Impact on broader e-commerce and offline retail

The rise of q-commerce is undeniably sending ripples across the entire retail ecosystem, forcing existing players to adapt or risk obsolescence. This new speed paradigm is creating distinct operational models and consumer expectations compared to established channels.

Table: Q-commerce vs. traditional e-commerce & offline retail for apparel

|

Feature

|

Q-commerce (apparel)

|

Traditional e-commerce (apparel)

|

Offline retail (apparel)

|

|

Delivery Time

|

10-60 minutes

|

1-5 days (or more)

|

Instant (in-store purchase)

|

|

Product Range

|

Limited, curated essentials, basics, high-demand items

|

Extensive, wide variety of brands, styles, collections

|

Variable, depends on store size & specialization

|

|

Primary Driver

|

Speed, immediate need, impulse

|

Selection, price, planned purchases, brand discovery

|

Touch & feel, trial, immediate possession

|

|

Key Challenge

|

Profitability, inventory for fashion, returns logistics

|

Competition from q-commerce, delivery speed expectations

|

Competition from online, footfall decline

|

|

Consumer Focus

|

Urgent, need-based, convenience-seeking

|

Broader consideration set, brand loyalists

|

Experiential shoppers, immediate need, local

|

|

Supply Chain

|

Hyperlocal dark stores, real-time inventory

|

Centralized/regional warehouses, planned logistics

|

Physical stores, traditional distribution

|

Standard e-commerce, with its 1-3 day delivery window for apparel, is facing new pressures. Q-commerce is reportedly taking market share from both traditional e-commerce giants and local stores. Recognizing this shift, even established large e-commerce platforms are now offering "Next Day Prime" apparel, but the 15-minute delivery benchmark set by q-commerce establishes a significantly higher bar for immediacy. In response, some apparel-specific e-commerce platforms are reportedly investing in their own dark stores to pilot hyperlocal models in major cities, attempting to bridge the gap.

Offline retail, particularly small, local apparel stores and boutiques, are also feeling the impact. "Our walk-ins for basics have dropped 20 per cent YoY," revealed the owner of a multi-brand boutique in Delhi. "We’re launching a 60-minute delivery promise via a hyperlocal delivery service to compete." This indicates a move by some offline players to adopt quicker fulfillment methods to retain their customer base.

Experts are increasingly convinced that Q-commerce for certain apparel segments is here to stay. Predictions suggest that by 2027, up to 22 per cent of urban apparel orders in India could be fulfilled via q-commerce, particularly for categories like: innerwear, athleisure, loungewear, basic apparel and seasonal items or those driven by pop culture trends

However, luxury fashion, high-value occasion wear, and categories requiring extensive browse or trial are deemed unlikely to transition to the 15-minute model. The model works best where urgency meets low consideration. That’s a sweet spot where Q-commerce will dominate, say retail analysts.

Convenience is king

Fast fashion is acquiring a new definition – it's no longer just about rapidly changing trends, but literally about the speed of acquisition. India's Q-commerce sector is adeptly carving out a new niche, not necessarily by competing with high-fashion labels or elaborate retail experiences, but by addressing everyday wardrobe gaps and urgent needs.

What might have started as an almost whimsical query, "Who needs a T-shirt in 15 minutes?" has rapidly evolved into a practical urban fashion utility. As a young working professional from Bengaluruput says he didn’t plan to shop or go out. So he hit order—and his joggers arrived before the food did.

This sentiment underscores a fundamental truth: Q-commerce in apparel is less a gimmick and more a direct response to an evolving consumer mindset where convenience reigns supreme.