11 September 2024, Mumbai

India's Gen-Z, the cohort born between the mid-1990s and early 2010s, is rapidly emerging as a dominant force in the consumer landscape. Their distinct preferences and behaviors are reshaping markets and challenging traditional business models. With their increasing spending power and distinct preferences, businesses are scrambling to understand and cater to this influential demographic.

India's Gen-Z population is estimated at over 250 million, making up a substantial consumer base with immense spending power. As per Statista, the apparel market in India was valued at $59.3 billion in 2020 and is projected to grow at a CAGR of 9.7 percent to reach $118.2 billion by 2028. Gen-Z is expected to contribute significantly to this growth, with their spending on fashion estimated to reach $30 billion by 2025.

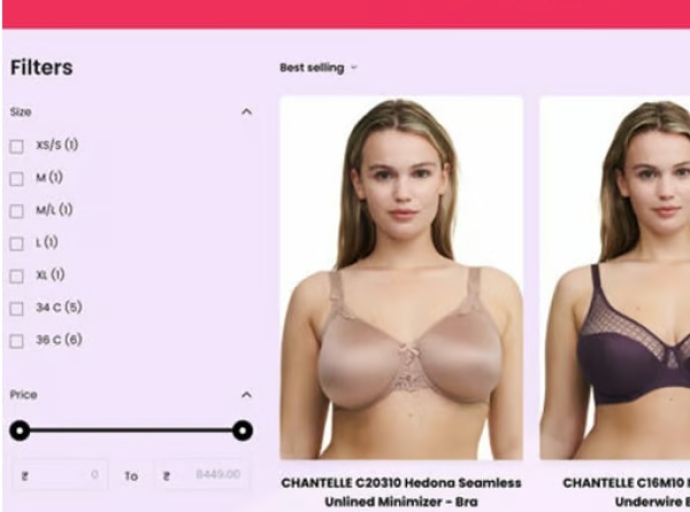

In fact, the fashion and apparel sector is a prime example of Gen-Z's influence. Their preferences for trendy, sustainable, and personalized clothing are driving brands to adapt. Online shopping is the preferred mode for 65 per cent of Gen-Z, with social media and influencer marketing playing a critical role in their purchase decisions.

A generation apart

Several key characteristics distinguish Gen-Z from their predecessors.

• Digital natives: Gen-Z has never known a world without the internet. They are hyper-connected, using social media, online communities, and e-commerce platforms for everything from socializing to shopping.

• Value-driven: This generation prioritizes brands that align with their values, such as sustainability, inclusivity, and social responsibility. They are more likely to support businesses that make a positive impact.

• Individualistic: Gen-Z celebrates individuality and self-expression. They seek unique products and experiences that allow them to stand out from the crowd.

• Experiential: This generation values experiences over material possessions. They are willing to spend on travel, concerts, and other events that create lasting memories.

• Socially conscious: Gen-Z is more aware of social and environmental issues than previous generations. They prefer brands that align with their values, such as those promoting sustainability, inclusivity, and ethical practices.

As consumers Gen-Z's consumption behavior is heavily influenced by digital platforms. They discover new brands, research products, and make purchases online. Gen-Z expects a seamless shopping experience, with options like online ordering, fast shipping, and easy returns. Social media, influencer marketing, and user-generated content play a critical role in their decision-making. Gen-Z values experiences over material possessions. They're willing to spend on travel, concerts, and other experiences that create lasting memories. They seek brands that are transparent and genuine, rejecting those that feel inauthentic or overly promotional. This influences their fashion choices, as they seek clothing that enhances their experiences. And then there is the whole issue of FOMO (Fear of Missing Out). The constant stream of information and social media updates fuels Gen-Z's FOMO. They want to stay on top of the latest trends and feel included. This can lead to impulsive buying and a desire for instant gratification. Moreover, Gen-Z relies heavily on recommendations from friends and online communities.

Changing market and business dynamics

Gen-Z's preference for online shopping and personalized experiences has resulted in the growth of Direct-to-Consumer (D2C) brands. These brands bypass traditional retail channels, offering unique products and a direct connection with consumers. The integration of social media and e-commerce is transforming the way Gen-Z shops. Platforms like Instagram and TikTok are becoming powerful sales channels, allowing brands to engage with consumers and drive purchases directly within the social media environment. And brands that prioritize sustainability and ethical practices are gaining favor with Gen-Z. This includes using eco-friendly materials, reducing waste, and ensuring fair labor practices throughout the supply chain.

Another major factor is Gen-Z population in Tier I cities and metros has the highest disposable income and exposure to global trends. They're more likely to shop online, experiment with international brands, and follow fast-fashion trends. Comparatively Gen-Z in Tier II and III cities like, Jaipur, Lucknow, Coimbatore etc, are rapidly catching up in terms of consumption patterns. They're increasingly shopping online, influenced by social media and aspirational lifestyles. However, affordability remains a key factor.

While Gen-Z is digitally connected, a significant social divide exists. Access to technology, education, and disposable income varies significantly across different socio-economic groups. This influences their consumption choices and access to fashion trends.

The bottomline is, India's Gen-Z is a powerful consumer force, reshaping markets with their digital-first approach, value consciousness, and social awareness. Their preferences for personalized experiences, sustainable brands, and unique styles are challenging traditional business models and driving innovation in the fashion and apparel industry. Understanding their nuanced behavior and the demographic and social divide across India's cities is crucial for brands seeking to connect with this influential generation.

Latest Fashion news