India's premier luxury multi-designer fashion retailer, Aza Fashions plans to expand into the United States with its cutting-edge global shopping mobile app and convenient doorstep delivery service spanning all US states. Aza is renowned for curating the pinnacle of Indian fashion, embodying modern luxury and unparalleled service. Through its website and mobile app, Aza showcases over 1,000 brands from across India, presenting the epitome of Indian design and craftsmanship to clientele worldwide.

Based in Mumbai, Aza is an omni-channel brand that offers apparel and accessories from India's most celebrated designers, including Sabyasachi, Seema Gujral, Rohit Bal, Anamika Khanna, Tarun Tahiliani, Ritu Kumar, Masaba, Amit Aggarwal, Papa Don't Preach, Payal Singhal, Shantanu & Nikhil, etc. Aza also champions emerging talent, providing a platform for brands like Aseem Kapoor, Paulmi & Harsh, Lashkaraa, and Ariyana Couture. As a pioneering force in the organized Indian luxury fashion industry, Aza remains dedicated to delivering unmatched quality and service.

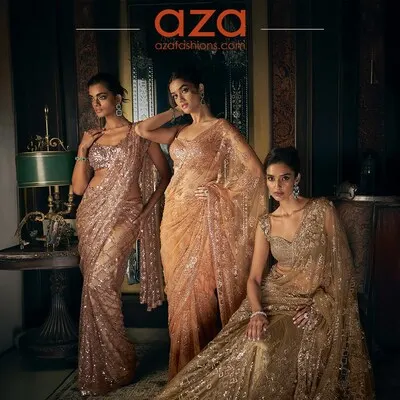

Dr. Alka Nishar, Founder & Chairperson, Aza Fashions, says, the brand is committed to showcase the exquisite craftsmanship and timeless elegance of Indian design. From intricately embroidered sarees and lehengas to chic holiday kaftans, Aza offers an extensive and exclusive collection reflecting the diverse cultural heritage of India.

Devangi Parekh, Managing Director, Aza Fashions, adds, the company’s popularity stems from its ability to cater to a wide range of preferences and occasions, whether it's weddings, festivals, or black-tie events. Its trained stylists collaborate with clients to curate and customise pieces that resonate with their individual style.

Proving an immersive shopping experience, the Aza app features convenient functionalities like image search, styling recommendations, and outfit customisation, alongside seamless customer service and hassle-free return policies. With new collections introduced daily and curated edits for special occasions like Diwali, Eid, and Raksha Bandhan, Aza's wedding store boasts a vast array of bridal lehengas, bridesmaid sarees, sherwanis, kurta sets, accessories, and fashion jewelry.