15 September 2022, Mumbai:

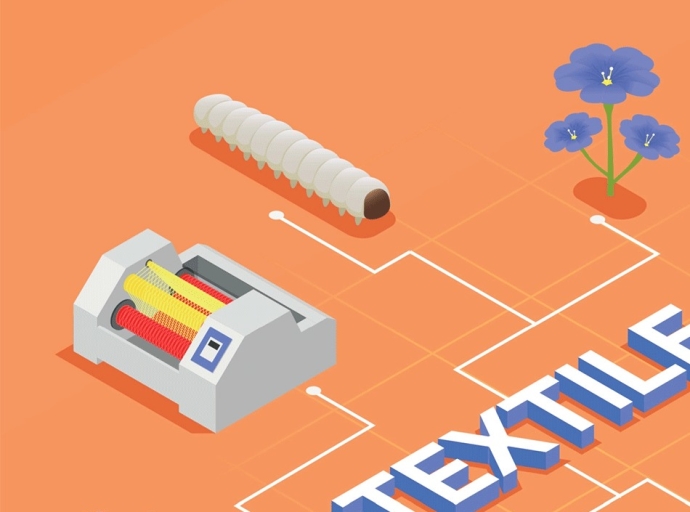

The textile and fashion industry arguably is one of the water's thirstiest sectors as its long supply chain is regarded to be the heaviest water consumer from fibre production to finished product. A deep dive into water shows that it is used extensively by the textile industry during all of its many processes, including size, desizing, mercerizing, scouring, bleaching, printing, and finishing. The consumption of considerable volumes of "virtual water," or water that cannot be utilized for anything else owing to evaporation or pollution, is sometimes overlooked in water footprint estimates, in addition to processing.

The industry's environmental effect, however, is not only dependent on the amount of water it uses. A wide range of contaminants that impair external water resources can also be found in the effluent from the textile manufacturing process. Numerous factors, including the kind of facility, as well as the technologies, processes, fibers, and chemicals employed, affect the kind and quantity of pollutants produced. For example, processing cotton and wool fibers use more water compared to manufacturing nylon and polyester materials.

Environmental impact

But the industry's impact on the environment is not only a function of how much water it consumes. The wastewater from the textile production process also contains a variety of toxins that harm external water resources. The kind and quantity of pollutants generated are influenced by a wide range of variables, including the type of facility, as well as the technologies, processes, fibers, and chemicals used. For instance, as compared to the production of nylon and polyester materials, the processing of cotton and wool fibers needs more water.

Water Footprint and how to calculate it

As previously stated, a water footprint calculation must take into account virtual water or the entire amount of water consumed during all manufacturing processes. Virtual water either evaporates or gets too contaminated to be used by humans throughout the textile preparation process. For example, generating a kilo of cotton in India uses an average of 22,500 L (or 6,000 gallons) of water, however, this significant water use for fiber production is sometimes overlooked when calculating the water footprint of the textile processing industry.

Understanding the LCA

Given rising water costs, regulatory constraints, demand from other businesses and people, and regulatory pressures, the textile industry is taking considerable steps toward sustainability. Although there are effective biological and chemical methods for processing textile effluent, the chemicals employed in chemical treatment are sometimes pricy and harmful to the environment. However, certain bacteria utilized in biological treatment cooperate to safely digest additional substances and complex organic wastes, lowering COD, BOD, and nitrogen levels in the process.

Decentralized wastewater treatment makes sense for the textile sector since it puts treatment closer to the place of production. Additionally, when It Comes To Water Security, Businesses Cannot Choose To Wait thus treating textile effluent at the point of origin is a business imperative, before it is diluted in sewers besides greatly boosts efficiency. It is nothing to frown upon that these fees can be decreased in regions where municipal facilities charge extra for excessively dirty water.

Water crisis could trigger World War III, says expert

The water footprint is one of the reliable metrics for quantifying water consumption. Water is necessary for life, as said, but it is also the most endangered critical resource on the planet.

The article highlights the water footprint of the textile and fashion industry from fiber to fashion which is very regrettable. The good bit is to quell the concern Greenpeace is fighting for an end to the industry's use of dangerous, persistent, and hormone-disrupting chemicals in our water, and the textile industry is supporting changes in the use of eco-friendly chemicals and water conservation.

Join our community on Linkedin

_thumbnail.jpg)