22 November 2024, Mumbai

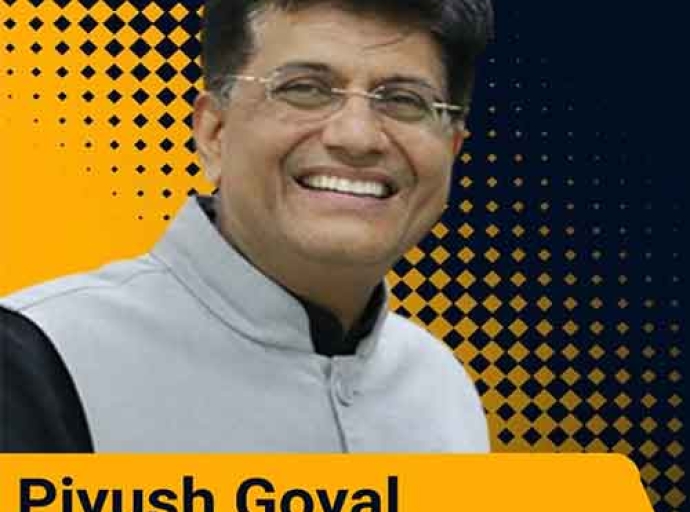

Commerce and Industry Minister Piyush Goyal recently stressed that e-commerce companies must adhere to Indian laws, both in letter and spirit, during a Mumbai event on November 19. His comments were in response to concerns about the impact of quick-commerce platforms on traditional kirana stores.

Goyal reiterated the government's stance on foreign direct investment (FDI) in e-commerce, emphasizing that e-commerce companies must follow regulations, especially the prohibition of FDI in multi-brand retail and inventory-based models.

This statement comes after the Confederation of All India Traders (CAIT) accused quick-commerce platforms like Blinkit, Instamart, and Zepto of undermining kirana businesses by misusing FDI norms and offering unsustainable discounts to cover losses.

A recent survey by Datum Intelligence supports these claims, forecasting that $1.28 billion in sales will shift from kirana stores to quick commerce platforms in 2024. The survey also predicts that the quick commerce sector will reach $40 billion by 2030, contributing to a decline in sales for traditional retailers.

Goyal's comments reflect growing concerns about the competitive pressure posed by these platforms on small retail businesses across India.