All Stories

26 March 2022, Mumbai:

The Odisha government has submitted a proposal for establishment of a textile park under the PM Mega Integrated Textile Region and Apparel (PM MITRA) scheme. In all, the Centre has received 17 proposals from 13 states for the establishment of textile parks.

Odisha plans to set up the proposed textile park at the special economic zone (SEZ) of Tata Steel at Gopalpur in Ganjam. Around 1,000 acres have been identified by state-owned Idco within the SEZ for the facility.

RELATED NEWS Darshana Jardosh: PM MITRA proposals under evaluation

The parameters devised for selection of sites for PM MITRA parks include connectivity to the site, existing ecosystem for textiles, availability of utility services at site, state industrial/textile policy and environmental/social impact.

Though initially the textile park was planned at Neulopoi in Dhenkanal district, the location was changed as it comes under an eco-sensitive zone.

Join our community on Linkedin

25 March 2022, Mumbai:

The Union Minister of State for Textiles Darshana Jardosh informed Lok Sabha that currently all the proposals received from states for setting up of textile parks under the PM Mega Integrated Textile Region and Apparel (PM MITRA) are under scrutiny for consideration by the project approval committee.

She said this in a written reply on Wednesday to a question raised by Bhubaneswar MP Aparajita Sarangi, as the Odisha government is among one of the states who have sent out the proposals.

The central government has received a total of 17 proposals from 13 states for the establishment of textile parks under PM Mega Integrated Textile Region and Apparel (PM MITRA) having an outlay of Rs 4,445 crore.

Textile minister Jardosh said the parameters devised for selection of sites for PM MITRA parks include connectivity to the site (25 percent), the existing ecosystem for textiles (25 percent), availability of utility services at site (20 percent), state industrial/textile policy (20 percent) and environmental/social impact (10 percent).

Join our community on Linkedin

CREDITS: KNN India (The news article has not been edited by the DFU Publications staff).

23 March 2022, Mumbai:

In order to be more sustainable, Boohoo, a British clothes online shop, has partnered with CottonConnect. CottonConnect is a non-profit organization that works with Pakistani farmers to help them grow cotton in more environmentally friendly ways.

Together, Boohoo and CottonConnect have assisted in the training of 2,500 farmers on how to grow cotton in a more sustainable manner, allowing the British e-tailer to trace the cotton down to the village where it is grown.

Training at specially built demonstration plots was required for the development of Responsible Environment Enhanced Livelihoods (REEL) cotton. 'Ready for the Future' labels are prominently displayed on Boohoo goods produced with REEL cotton.

ALSO READ World Cotton Day is observed by the Indian textile sector

The REEL procedure aids the company in tracing and tracking cotton across the supply chain. The cotton is then washed and ginned before being taken from the field to be spun into yarn, woven into cloth, and coloured.

RELATED NEWS H&M Foundation and Fotografiska Stockholm join forces to showcase planet positive solutions

CottonConnect also informs farmers about the advantages of minimizing pesticide use. The Boohoo Group is a British online fashion shop that caters to young people aged 16 to 30. The company was established in 2006 and had revenues of £856.9 million in 2019.

Join our community on Linkedin

CREDITS: Eco Textile Apparel Resources & Fashion Network.

25 March 2022, Mumbai:

The joint bid of Reliance Industries and Assets Care & Reconstruction Enterprise (ACRE) for debt-ridden Sintex Industries has been moved before the NCLT for its approval after getting unanimously selected by the lenders of the textiles maker.

The resolution professional of Sintex Industries has filed the resolution plan by RIL and ACRE, as approved by the Committee of Creditors (CoC) before the Ahmedabad Bench of the National Company Law Tribunal (NCLT), said a regulatory filing.

_large.jpeg)

ALSO READ Sintex Inds: RIL-ACRE revise offer

''... we would like to inform that the Interim Resolution Professional of the Company has duly filed the resolution plan as approved by the CoC with the NCLT, Ahmedabad Bench on 23rd March, 2022, in accordance with Section 30(6) of the Insolvency and Bankruptcy Code, 2016,'' it said.

RELATED NEWS Bidders for the textile company Sintex have submitted amended resolution plans

As per the IBC procedures, RP has to submit the resolution plan as approved by the CoC to NCLT under Section 30(6) of IBC, which gives its final approval.

Join our community on Linkedin

CREDITS: ET Business Today (The news article has not been edited by DFU Publications staff)

24 March 2022, Mumbai:

RECOVERY OF GLOBAL MACHINERY MARKET GENERATES STRONG RESULTS IN 2021 STRONG TESSENDERLO GROUP RESULTS IN LINE WITH EXPECTATIONS.

After the balance date:

▪ Following the launch of the new Connect generation weaving machines in 2021, Picanol introduced the

OmniPlus-i TC Connect in January 2022.

ALSO READ PICANOL GROUP TO BUILD NEW HEAD OFFICE IN IEPER

REVENUE

2H21 revenue increased by 32% compared to the same period last year. The Machines & Technologies revenue increased by 30% as the global machine market continued its strong recovery after COVID-19.

ADJUSTED EBITDA

The 2H21 Adjusted EBITDA amounts to 194.3 million EUR compared to 166.2 million EUR one year earlier, or a 17% increase.

The Adjusted EBITDA of segment Machines & Technologies decreased by 8.8 million EUR (-26%) as the unprecedented increase in raw material prices could not be fully re-charged to the customers.

RELATED NEWS Picanol Group: Upward revision of 2021 outlook as a Result of Impact of Tessenderlo Group’s Agro Segment

NET FINANCIAL DEBT

As per year-end 2021, group net financial debt amounts to 34.9 million EUR, which implies leverage of 0.1x (2020: 97.1 million EUR or leverage of 0.3x). Short-term borrowings for 215.3 million EUR and 196.2 million EUR long-term borrowings are partially compensated by cash and cash equivalents (366.7 million EUR) and short-term investments (10.0 million EUR of short-term banknotes with a maturity date in January 2022).

Join our community on Linkedin

CREDITS: Corporate Communication (MBX)..The news article has not been edited by DFU Publications staff.

21 March 2022, Mumbai:

Lenders to the debt-ridden Sintex Industries have approved Reliance Industries’ over Rs 3,650 crore bid for the Gujarat-based company.

RIL, which has partnered with stressed asset buyer Assets Care & Reconstruction Enterprise (ACRE) for the Sintex bid, has also offered a 15% equity to lenders.

The RIL-ACRE resolution plan now needs the approval of NCLT-Ahmedabad.

_large.jpeg)

ALSO READ Sintex Inds: RIL-ACRE revise offer

"As per Resolution Plan of Reliance Industries Limited jointly with Assets Care & Reconstruction Enterprise Limited it is proposed that existing share capital of the company shall be reduced to Zero and the Company will be delisted from the stock exchanges i.e. BSE and NSE," the company said.

RELATED NEWS Bidders for the textile company Sintex have submitted amended resolution plans

"The e-voting on approval of Resolution Plan was concluded on March 19, 2022, at 10.00 pm, and the 100 percent CoC members have duly approved the resolution plan submitted by Reliance Industries Ltd jointly with ACRE," the filing said.

Sintex Industries has also received bids from Welspun Group firm Easygo Textiles, GHCL and Himatsingka Ventures, Shrikant Himatsingka and Dinesh Kumar Himatsingka were placed before the CoC for consideration during the voting process.

Join our community on Linkedin

CREDITS: TOI MINT NDTV (The news article has not been edited by DFU Publications staff)

25 March 2022, Mumbai:

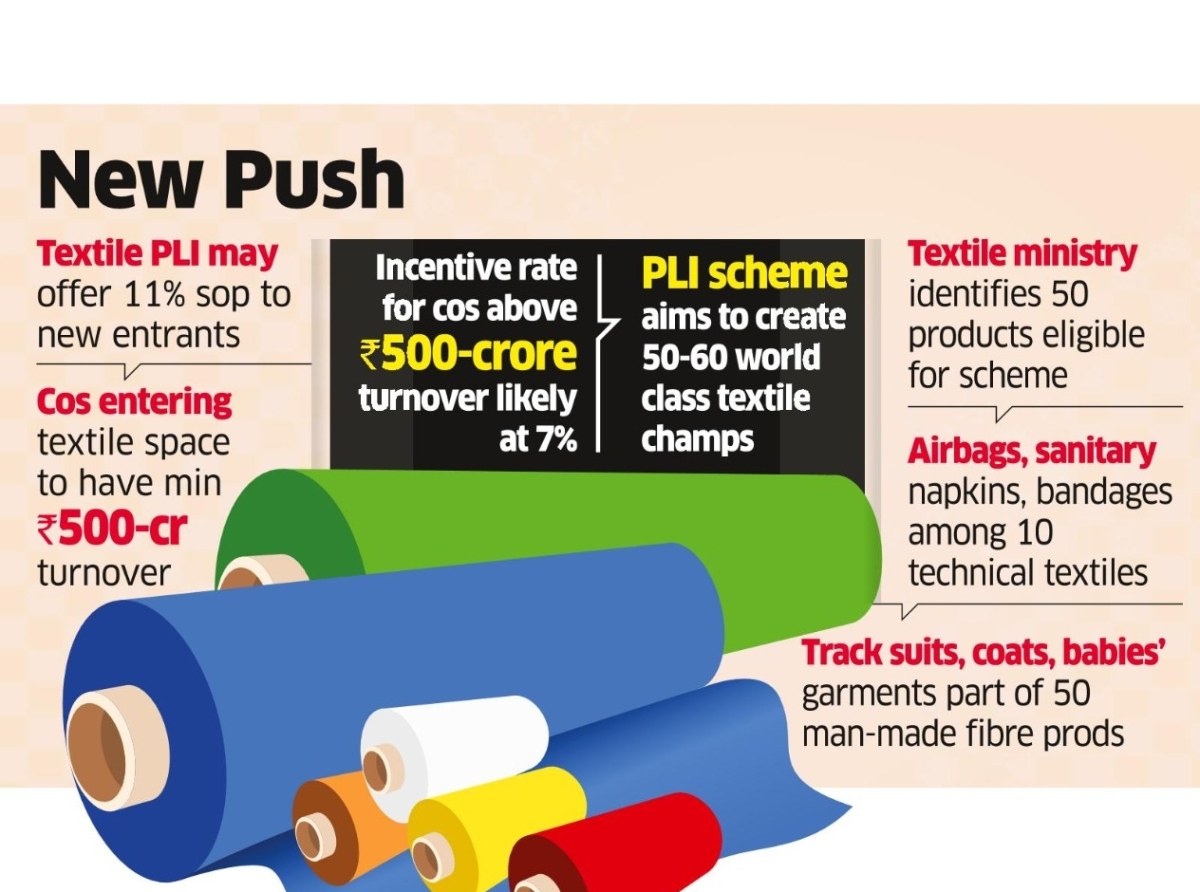

There is a huge scope for the manmade fiber segment both in India and globally, opines Darshana Vikram Jardosh, Union Minister of State for Textiles. Addressing members of the Synthetic and Rayon Textiles Export Promotion Council (SRTEPC) at its Export Award Function, Jardosh said, the government has approved Production Linked Incentive (PLI) Scheme for Textiles to boost the MMF sector in India.

With an outlay of Rs 10,683 crore, the scheme aims to promote production of MMF apparel, fabrics and products of technical textiles in the country. The government has also approved setting up of Seven Greenfield and Brownfield Pradhan Mantri Mega Integrated Textile Region and Apparel Parks with an outlay of Rs. 4,445 crore for seven years upto 2027-28.

ALSO READ Darshana Jardosh: PM MITRA proposals under evaluation

These parks will make the Indian textile industry globally competitive, attract large investment and boost employment generation.

The scheme of Rebate of State and central Taxes and Levies (RoSCTL) effective from March 2019 has been extended till March 31, 2024 for export of apparels, garments and madeups in order to make the technical textiles industry on par with the best in the world.

In addition, the government is implementing various schemes viz the Amended Technology Upgradation Fund Scheme (ATUFS), Schemes for the development of the Powerloom Sector(Power-Tex), Scheme for Integrated Textile Parks (SITP), SAMARTH- The Scheme for Capacity Building in Textile Sector, etc. for attracting investments and upgradation of skills in the Textiles sector, said Jardosh.

Join our community on Linkedin

23 March 2022, Mumbai:

Innovative, fashionable, sustainable will define the Denim Show as the industry will get together to showcase their prowess at its first-ever Mumbai edition from 12 – 14 May 2022 at the newly launched Jio World Convention Centre (JWCC) in BKC.

As one the fastest recovering market segments post the pandemic outbreak, the denim industry is pegged to showcase a sustainable growth rate of 12% CAGR, highlighted Denim Manufacturer Association’s (DMA) Secretary General Mr Gagandeep Singh.

ALSO READ Denim Show will be held alongside Gartex Texprocess India 2021

All set for its Mumbai launch, the Denim Show aims to bring the India’s denim mills and leading brands together to tap opportunities through the versatility of denim - the fashion statement of future.

Leading brands such as Hyosung India, Jindal Worldwide, Arvind, Ginni International, Raymond UCO Denim, Bhaskar Denim, LNJ Denim, Oswal Denims, KG Denim, Nandan Denim, and Ashima Group among others have confirmed their participation for the Mumbai launch.

The show will be jointly organised by Messe Frankfurt Trade Fairs India Pvt Ltd and Mex Exhibitions Pvt Ltd under the umbrella of Gartex Texprocess India, and cover the latest developments in textile, garment machinery and screen printing with the objective to encourage investments, new market development and enable India to be a globally competitive textile and denim manufacturing destination. India is the world’s second largest producer of denim fabric after China.

RELATED ARTICLE Bangladesh Denim Expo in Dhaka on 11th and 12th November: An Overview

“The Indian denim market capacity, at present, is approximately 1.6 BN meters p.a. and approximately 150 MN meters capacity.” added Mr Gagandeep Singh.

The Indian denim industry has evolved significantly with ever changing fashion trends making its way into other utility-driven products. Innovative, fashionable, sustainable is what the organisers define will be the focus of the Denim Show in 2022.

Join our community on Linkedin

21 March 2022, Mumbai:

SIMA welcomes fund allocation for Sustainable Cotton Cultivation Mission announced in the Tamilnadu Agriculture Budget 2022-23.

Tamilnadu textile industry which accounts for 1/3 rd of the textile business size of the country provides direct jobs to over sixty lakh people is predominantly cotton-based.

Tamilnadu textile industry needs 120 lakh bales of cotton annually (170 kgs each), while the State produces only five lakh bales per year.

The Association has been pleading the Hon’ble Chief Minister to give more thrust for cotton development in Tamilnadu, as the spinning mills in the State spend between Rs.3/- and Rs.6/- per kg towards transportation to source cotton from other States and cost of the same has been increasing steeply with the increase in diesel price.

ALSO READ SIMA: TN Budget 2022-23, Growth oriented one

Consequently, the Hon’ble Chief Minister has launched Sustainable Cotton Cultivation Mission and is encouraging cotton development in the State.

In a Press Release issued here today, Mr.Ravi Sam, Chairman, The Southern India Mills’ Association (SIMA) has thanked the Hon’ble Chief Minister, Mr.M.K.Stalin and Hon’ble Minister for Agriculture, Mr.M.R.K.Paneerselvam for allocating Rs.33,007.68 crores to the Agriculture Department in the State Agriculture Budget for the year 2022-23 which would greatly benefit the farmers at large and cotton farmers in particular.

He has been thanked for allocating Rs.15.32 crores in the budget to enhance the cotton yield.

He has pointed out that the average cotton yield per hectare in the State is around 585 kgs as against the world average of 805 kgs while over 20 countries achieve over 1500 kgs per hectare.

RELATED NEWS SIMA, CHAIRMAN: Indian Textile Mills concerned about global order cancellations

He has said that SIMA Cotton Development & Research Association (SIMA CD & RA) has been closely working with the Department of Agriculture in implementing various schemes relating to cotton.

Ravi Sam has said that the State has the potential to increase cotton production from the current level of 5 lakh bales to 15 lakh bales in five years with the proposed Mission.

He has added that the State would give importance to the cultivation of sustainable, extra-long-staple cotton and SIMA CD & RA is fully equipped to implement the Mission right from the supply of genetically pure seeds.

Join our community on Linkedin

25 March 2022, Mumbai:

For the PM Mega Integrated Textile Region and Apparel (PM MITRA) Parks, Madhya Pradesh (MP) has submitted four ideas.

When compared to the suggestions filed by 13 states, this is the most. Ratlam, Devas, Dhar, and Katni are among the areas for which the MP has presented plans. Karnataka has also filed two projects, one in Vijayapura and the other in Gulbarga.

Only one proposal has been filed for this huge project by the remaining 11 states.

ALSO READ Darshana Jardosh: PM MITRA proposals under evaluation

Darshana Jardosh, Minister of State for Textiles, informed the Lok Sabha (lower house) that a total of 17 preliminary project proposals had been received from various state governments, and that these projects are now being reviewed by the Project Approval Committee.

The Union Government has sanctioned the establishment of seven PM MITRA Parks in Greenfield/Brownfield locations to construct world-class infrastructure, including plug-and-play capabilities, at a cost of Rs.4,445 crore over seven years, from 2027 to 2028.

The programme focuses on the development of a vast region that is expected to become a fruitful ground for all actors in the textile value chain to conduct textile sector economic operations. Per PM, 1 lakh direct and 2 lakh indirect employment are likely to be created.

MITRA Parks are beneficial to the community and its residents.

A provision for social infrastructure is also included.

All textile employees affiliated with the PM MITRA Park will benefit as a result of this since their total income and quality of life will improve.

Join our community on Linkedin

CREDITS: Apparel Resources.

23 March 2022, Mumbai:

Cotton yarn exports from India continue to rise, reaching an all-time high in January of this year. In the first month of 2022, the country sent US $ 493.30 million in cotton yarns (up 96.92 percent on a year-over-year basis), the highest ever export income in the category in January.

The previous highest export revenue in cotton yarns was US $ 435.73 million in January 2014. It's worth mentioning that, despite domestic protests, India's cotton yarn export profits in 2021 were US $ 4.69 billion, or a 79.64 percent annual increase.

With sales of US $ 220.45 million and US $ 32 million, respectively, exports to Bangladesh and Turkey have remained unstoppable.

On the one hand, cotton yarn exports to Bangladesh increased by 338.36% in January '22 over January '21; on the other hand, Turkey opened up new growth opportunities for India with a tremendous 1,503% annual rise, despite the fact that shipping to this nation was just US $ 2 million a year before.

What's fascinating is China's decline, since Indian cotton yarn shippers appear to be fleeing the nation in search of new markets where Indian cotton yarn may get a foothold.

RELATED NEWS Imports of cotton trousers in the United States: China loses ground in 2021; others maintain their lead

In January of this year, shipments to China fell by 59.24 percent to US $ 23.65 million, compared to US $ 58 million in January of the previous year. Even Portugal kept ahead of China, with imports of Indian cotton yarns reaching US $ 25.78 million in January '22, an increase of 324.86 percent on an annual basis.

Join our community on Linkedin

CREDITS: Apparel Resources.

18 March 2022, Mumbai:

ITMA 2023, the 19th showcase of the world’s largest textile and garment technology exhibition is on track to occupy 12 halls of the Fiera Milano Rho exhibition complex.

The exhibition has drawn an enthusiastic response from leading textile and garment technology manufacturers, according to CEMATEX (European Committee of Textile Machinery Manufacturers), the show owner of ITMA. More than 93 percent of the exhibition space has been sold by the application deadline of 15 March 2022.

A total of 1,364 applicants from 42 countries have booked over 111,000 square meters of net exhibition space.

_large.jpeg)

ALSO READ ITMA 2023: Start-Up Valley

Mr Ernesto Maurer, President of CEMATEX, said: “The response to ITMA 2023 has exceeded our expectations despite the economic and geopolitical uncertainties confronting the global business community.

We appreciate the strong endorsement from the industry. The space booking status shows the industry’s confidence in ITMA as the best global launch pad of the latest technologies and innovations.

RELATED NEWS 'ITMA Live series' to feature Innovative Technologies

” Mr Charles Beauduin, Chairman of ITMA Services, the organiser of ITMA 2023, added: “After weathering over two years of the pandemic, the global business community is eager to get down to real business.

Businesses are looking at long-term investments in key technologies to remain competitive. As the world’s most established showcase of its kind, ITMA is the quintessential platform for the industry to buy and sell, and to collaborate face-to-face.”

Join our community on Linkedin

CREDITS: ITMA.