All Stories

BRAND ANNOUNCEMENT | VOGUE EYEWEAR WELCOMES SHAHID KAPOOR, WHO JOINS TAAPSEE PANNU AS ITS BRAND AMBASSADOR IN INDIA.

Vogue Eyewear proudly welcomes Bollywood actor Shahid Kapoor as the new brand ambassador, marking an exciting new chapter for the iconic eyewear brand. Shahid joins longstanding brand ambassador Taapsee Pannu in a visually captivating campaign film that emphasizes Vogue Eyewear’s commitment to individuality, self-expression, and personal style.

In a world where conformity often takes center stage, the campaign reinforces brand ethos through the lens of the ‘No Rules Club’ and celebrates those who live life on their own terms. The film reaffirms that being true to oneself is the only rule that matters.

In a striking film set within a modern, gallery-inspired space, Shahid and Taapsee share a dynamic blend of playful banter and introspective moments. The setting serves as a powerful metaphor that just like art, style too thrives in freedom. The film further underlines that in a world of expectations and norms; one should live life unencumbered.

“Style to me has always been about self-expression without boundaries. I’m excited to join Vogue Eyewear and to be part of its campaign, that encourages people to be themselves, unapologetically and without rules,” said Shahid Kapoor.

Echoing this spirit, Taapsee Pannu added, “Working with Vogue Eyewear has always been about embracing who I am — unfiltered and free”. She also shared her excitement about the collaboration in the new campaign, “Together we hope to inspire more people to own their style, their way.”

As part of the Association’s international outreach, AATCC (American Association of Textile Chemists & Colorists) has recently signed a Memorandum of Understanding (MOU) with The Textile Association (India) (TAI).

Fashion Guru

The goals of the MOU include promoting communication between the two organizations; avoiding duplication of work efforts where possible; promoting knowledge of the standards development activities; engaging in educational activities in the fiber-to-fashion chain; utilizing the resources of AATCC and The Textile Association (India) to strengthen each other’s efforts to serve the people and companies in the Indian textile industry; and creating awareness of AATCC standards in India.

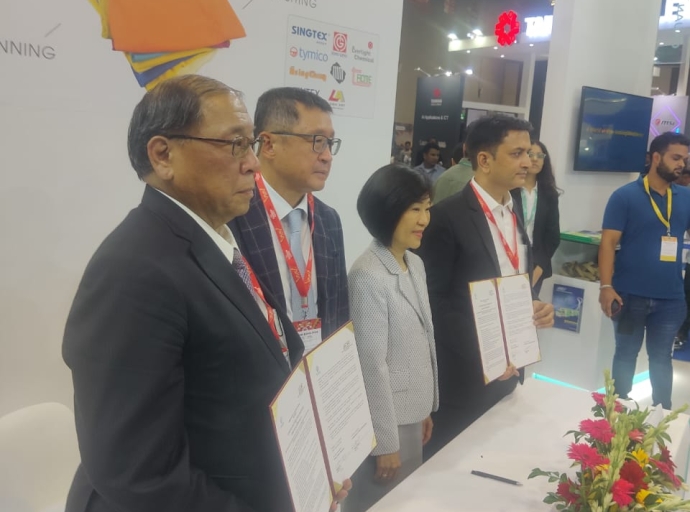

Interacting with Salil Chawla, DFU Publications earlier today with Justin Huang, the President of the Taiwan Textile Federation (TTF) @ Taiwan Expo, Pragati Maidan New Delhi (India) while singing a Memorandum Of Understanding (MOU).

It was done between Justin, TTF Taiwan, and on behalf of CITI, India Manoj Sharma in the presence of James Kuo, Chairman, TTF Taiwan.

Justin started by saying," This is a signature given to the MOU between TTF and Citi for the year 2024 to aim at the future collaboration between the two countries' textile industries. In Taiwan, we have labor shortage problem. We need to invest somewhere that has fruitful labor resources and a large market".

On the other hand, we know that Indian textile industries are urging to have some synthetic fibers, new technology, and sustainable technology.

So this is something that Taiwanese, we are doing very well and many retailers and brands around the world have well known us. So I think the given signature on this MOU will allow both countries' companies to find more collaborative opportunities in the future.

For sure, in the coming October, we are going to invite Citi to organize a visiting group to our globally popular TITAS'24 show, this type of innovative textile show from October 15th to 17th is one of its kind in the textile world. And next year, we hope we'll have some other visiting groups who come to India and to work together with our Indian pocket to find some trade and investment opportunities.

Replying to what are the key areas where you feel that Taiwan and India can get into, Justin alluded that India is a large country. For us, we are going to initiate some actions. For example, tomorrow we are going to Tamil Nadu to visit the companies over there to find a collaborative relationship with each other.

Regarding to Taiwan's textile industry overseas; investor facilities stand for another 31 billion dollars. But man, the major part of our investment is located in Southeast Asian countries and gradually extended to Bangladesh.

And now we found some investors have already started their business for manufacturing in India. So I think in the future, the collaboration between Taiwan and India will be more and more vertical.

Replying to what would be the route generally you think that your companies will come and directly invest or will they look for the five ventures of Indian partners? Justin had to say," We are generating these meeting points between the two countries' business professionals. Okay. They are the person to find the collaboration. So for TTF and for Citi, we are going to develop these channels, these platforms, and build up the relationships."

So far, the Western world has not yet been reflected. The global inflation is still over there. High inventory in retailers and not yet sold.

Strong focus on quality and compliance is reflected in exports growth: Chairman AEPCCommenting on the continued RMG export growth, Sudhir Sekhri, Chairman AEPC stated that, “India’s RMG exports have witnessed record growth despite global headwinds and disruptions due to ongoing wars; reflecting the resilience of industry to withstand tough times. We are now reaping the benefits of the RMG industry’s drive to strongly focus on quality and sustainability.

We have been successfully leveraging India’s raw material strength and manufacturing traditional as well as modern design products.

Our constant endeavour to be sustainable and affordable is a great attraction for international buyers which is reflected in recent months’ export growth.”

“Next year we are organizing India’s biggest textiles fair Bharat Tex 2025, which will be a great platform to showcase our potential. The global buyers and brands are eagerly waiting to source from India and we have been doing roadshows and roundtables to invite them. The response we are receiving from them is very encouraging,” Chairman AEPC Sekhri underlined.

Shri Mithileshwar Thakur, Secretary General, AEPC stated, “This is the time when the supply chain is getting re-aligned due to the Bangladesh crisis and the global buyers looking for China’s alternative.

Additionally, ongoing wars have disrupted the traditional trade routes adding to the cost burden. This is the appropriate time for the government to whole-heartedly support this labour- intensive sector through handholding, capacity augmentation, skilling, investment and sustained financial support to this MSME driven sector.”

The RMG industry has been making rapid strides and India is fast emerging as the preferred sourcing destination for international buyers and big brands.” We have requested for not only continuation of the interest equalization scheme but also enhancement of the interest equalization rate to 5% for at least five years to offset high cost of capital, SG AEPC added.

Union Textiles Minister Giriraj Singh inaugurated the 71st Edition of the India International Garment Fair (IIGF) in New Delhi today. The event saw the presence of Ramesh Bidhuri, Member of Parliament, Sudhir Sekhri, Chairman of AEPC, along with several prominent members of the trade, international buyers, and exhibitors.

In his inaugural address, Giriraj Singh highlighted India’s rapid economic growth, stating, "Today, India is one of the fastest growing economies in the world with a GDP growth rate of 7.2% and is expected to be the 3rd largest economy by 2027–28." He emphasized that the positive domestic outlook and growth-oriented political establishment have created a conducive business environment in India. The government has implemented various measures to enhance the infrastructure sector and ease of doing business, he added.

The Minister expressed his satisfaction that around 600 buyers from more than 50 countries would be attending this edition of IIGF. He also noted that the Indian apparel and textiles market, currently valued at USD 165 billion, aims to reach USD 350 billion. He urged the industry to boost apparel exports to USD 50 billion by 2030. Shri Singh mentioned that the Prime Minister has outlined a roadmap to promote technical fibers and geotextiles, providing significant growth opportunities.

Shri Singh stated, "My challenge is not Bangladesh. I aim to surpass China in the times to come. Bangladesh's water and raw material charges are increasing. Additionally, we should establish small clusters for smaller players in India to boost ready-made garment (RMG) exports." He stressed the need for revamping textile parks, promoting green textiles, adopting the 'hub and spoke' model to enhance domestic manufacturing, encouraging industry collaboration, and establishing Indian brands. The ministry also plans to revive the Scheme for Integrated Textile Parks.

Sudhir Sekhri, Chairman of AEPC, remarked, "The global headwinds negatively affected Indian apparel exports. But despite this adverse scenario, the Indian apparel export industry was able to hold its own and mitigate the damage to a significant extent. With a 9.8% increase in exports in May 2024, we are confident that under the visionary leadership of Hon’ble Prime Minister Shri Narendra Modi Ji and the guidance of Hon’ble Union Textile Minister Giriraj Singh Ji, we will overcome challenges and achieve impressive growth in exports."

Mithileshwar Thakur, Secretary General, observed, "The IMF's April 2024 World Economic Outlook forecasts the world economy to grow at 3.2% during 2024 and 2025, with a slight acceleration in advanced economies. Global inflation is also projected to decline steadily, from 6.8% in 2023 to 5.9% in 2024 and 4.5% in 2025. This indicates greater opportunities for Indian apparel exporters to expand their footprint in developed countries. The Indian apparel industry must capitalize on this opportunity and start dreaming big."

Knowledge sessions are being organized on June 25 and 26, 2024, covering topics such as "Navigating Global Trade: Challenges and Opportunities for the Industry," "The Efficiency Advantage: Driving Manufacturing Excellence in Apparel," and "Sustainable Fashion: From Concept to Reality."

The fair, organized by the Apparel Export Promotion Council (AEPC) through the International Garment Fair Association (IGFA) in collaboration with three major garment associations of India—Clothing Manufacturers Association of India (CMAI), Garment Exporters & Manufacturers Association (GEMA), and Garment Exporters Association of Rajasthan (GEAR)—showcases the collective spirit, teamwork, and synergies of these associations to achieve greater goals. The 71st edition also features two fashion shows each day from June 25 to 27, 2024, highlighting the best collections exhibited during the show.

At the TAF 2025 show, Salil Chawla, Director of DFU Publications, engaged in a conversation with Nicolas Koutros, Directeur Général Délégué.

Nicolas Koutros from Oberthur Technologies introduced their joint venture with Giriraj Foils, expressing their interest in understanding the Indian market and its challenges.

Their primary goal is to establish technology manufacturing and distribution in India.

The discussion highlighted India's status as the world's largest country, with emphasis on consumer awareness and brand protection. Nicholas emphasized that consumers play a crucial role in understanding their purchasing choices, while brand owners must take necessary steps to prevent counterfeiting.

Regarding anti-counterfeiting measures, Nicolas stressed the importance of utilizing modern media technologies for consumer awareness campaigns.

He emphasized that tackling counterfeiting requires a combination of different technological platforms rather than relying on a single solution.

On the topic of innovation, Nicolas highlighted its significance in staying ahead of counterfeiters, emphasizing the need for sustainable solutions in the industry. The discussion concluded with his hope for better understanding of both problems and potential solutions in the Indian market.

Marcelo Duarte Monteiro, Director ABRAPA who is based out of Singapore delivered a speech @ 3rd World Cotton Summit dated 7th Oct, 2024 in New Delhi reflecting on Brazil Cotton.

Climate resilience is an issue for all of us in agriculture, regardless of where you are, regardless if you're in Brazil, the U. S., or India. That's something we need to be taking into account.

Read more

We rely on exports as only 25% of our production stays in Brazil, so that's a huge asset you have here in India to have such a huge industrial base. As we don't have that robust industrial base in Brazil, we have to rely on exports..exports..exports but still, it does not impinge on our sustained growth trajectory.

I mean Brazil cotton has a high compliance work ethos and are entirely aligned with new standards everywhere they're coming out from i.e. gold standards and private standards, regulations, legislation whether in the U. S./ everywhere. Although, it has to be mentioned here that, increasing cross-border production are one of the challenges that we're facing.

About ABRAPA

The Brazilian Cotton Growers Association (Abrapa) is a nuanced COTTON BRAZIL initiative to promote Brazilian cotton to the international market.

Leading retail chain, Westside has launched an exclusive home collection titled, ‘Honey, I ‘m Home 2.0 in collaboration with the designer duo Saaksha & Kinni.

Featuring a diverse range of products, the Westside x Saaksha & Kinni offers table line, tote bags, kiminos, cushions, etc. The collection is being sold in select stores across multiple cities.

The curated vibrant handcrafted home range highlights the brands’ shared dedication to craftsmanship and their commitment to offer exceptional shopping experience to customers, says Lyndsay Smith, Head, Westside Home.

Adding a burst of colors to this season’s prints, the collection evokes a sense of adventure, mischief and fun, add designers Saaksha & Kinni.

Apparel Group Brand La Vie En Rose Donates to Al Jalila Foundation to Drive Breast Cancer Awareness

Dubai, Apparel Group’s premier lingerie brand, La Vie en Rose, proudly marked Breast Cancer Awareness Month with a meaningful contribution to Al Jalila Foundation, showcasing their commitment to women’s health and social responsibility in the UAE.

The initiative reflects La Vie en Rose's ongoing dedication to supporting breast cancer awareness and providing impactful contributions to women’s health initiatives.

Through its partnership with Al Jalila Foundation, Apparel Group and La Vie en Rose reaffirm their dedication to supporting local communities and championing initiatives that make a lasting impact.

Throughout October, a percentage of sales from selected stores of La Vie en Rose were allocated to Al Jalila Foundation, a leading institution in advancing medical research and health services. This donation underscores Apparel Group and La Vie en Rose’s commitment to making a positive difference within the community by raising awareness and supporting crucial health causes.

"Our partnership with Al Jalila Foundation is part of our unwavering commitment to supporting important causes across the region," said Neeraj Teckchandani, CEO of Apparel Group. "At Apparel Group, we believe that businesses can be powerful forces for social good, and we are honoured to contribute to the vital work Al Jalila Foundation does in breast cancer research and awareness."

India is set to make a strong impact at Yarn Expo Autumn 2024, held from August 27-29 at the National Exhibition and Convention Center in Shanghai. As a leading cotton producer, India will showcase its diverse range of cotton products in Hall 8.2, where over 40 Indian exhibitors will present their offerings, including cotton, melange, greige, and fancy yarns.

Organised by the Cotton Textile Export Promotion Council (Texprocil), the India Pavilion is the largest it has been in a decade, standing out among 500 exhibitors from 15 countries.

Indian suppliers continue to participate in this event due to its effectiveness as a business platform and the allure of the expansive Chinese market. MuraliBalakrishna, Joint Director of Texprocil, highlighted the strong demand for India's twisted cotton yarn, citing the Expo’s role in boosting global visibility for Indian exporters.

Notable Indian exhibitors include Indo Industries Pvt. Ltd., a prominent exporter of 100 per cent cotton yarn and fabrics to over 45 countries, and MananTextech Global Pvt. Ltd., a vertically integrated textile company offering a wide array of organic and man-made products. Another key participant is Padwa Worldwide LLP, known for its premium 100% cotton yarn produced with advanced technology.

Yarn Expo Autumn 2024 will feature more than 200 cotton suppliers, reflecting the high demand for cotton, which was one of the most sought-after categories at the previous Spring and Autumn editions.

Key global exhibitors include Heng Feng (Hong Kong) Co Ltd, PT Indo-Rama Synthetics Tbk (Indonesia), and Square Textiles PLC (Bangladesh), all bringing their unique cotton and blended yarn offerings to the event.

Running concurrently with Intertextile Shanghai Apparel Fabrics – Autumn Edition, CHIC, and PH Value, Yarn Expo Autumn will create significant business opportunities for participants, making it Asia’s premier international sourcing hub for yarns and fibers.

In conversation with Salil Chawla, Director of DFU Publications, and Eliana Zappala, the Deputy Trade Commissioner of the Italian Trade Agency in New Delhi, on the sidelines of the ITA event in India today at the Hyatt Regency, New Delhi, she alluded that, "we have organized this initiative to strengthen the presence of Italian machinery companies in India, where we already have a market share of 7%.".

We are here today with 11 Italian companies, producing machinery in the weaving, spinning, and dyeing of tissues, so many different, non-woven, different sectors, and they are here to present their new technologies and meet buyers here in Delhi. .

Then we will have some company visits tomorrow in the Delhi NCR area, and then we will move in Mumbai for the same format, meeting buyers coming from the Mumbai area. So we hope—I mean, it's quite a new experience for us because it's the first time we organized this kind of initiative, and we hope it will be fruitful for Indian and Italian companies too.

Then we will have some company visits tomorrow in the Delhi NCR area, and then we will move in Mumbai for the same format, meeting buyers coming from the Mumbai area. So we hope—I mean, it's quite a new experience for us because it's the first time we organized this kind of initiative—and we hope it will be fruitful for Indian and Italian companies too.

I think Indian market is growing year after year because I've been here since three years and I'm already very fine seeing some evolutions. We think that Italian companies can offer apart machineries, they offer, as we know, services, post -site services, and we need that last year for example at the Itma fair that is quite important for the sector very important we had thousands of Indians visiting the fair we had created even a fast track mechanism for the reasons with the embassy. Hence, we think India and the market can become much more important in in the next coming years.

Maybe there is direct competition with China? Probably for the moment, of course, China is still ahead because they started 20–30 years before they specialized in this sector, but in the last few years, even before Covid China has become a more expensive market because salaries, of course, as in all countries, have increased with the years.

So India could become, in the next year, the first market. Probably China will specialize in other sectors like EV, electrical, machinery, and electrical parts. And India can have its own specialization in a different from Bangladesh, Sri Lanka, Turkey, or any other country.

Even India is very important because it has a very big internal market. It's not only for re-export, but it's as it is in China. India has a very important internal market, which can be part of the production that is being done in India. But even though there is a strong belief on green technologies or recycling water,. So I see a very strong sensitivity to these green technologies in India.

About the ITA Event

Italian textile machinery makers visit India (Delhi & Mumbai) on April 9th & 11th to showcase latest technologies. Free workshops for textile & nonwovens industry decision-makers to learn about sustainable and efficient solutions, are held at the Hyatt Regency (Delhi) & Hyatt Centric Juhu (Mumbai).

Decision-makers and experts from the textile and nonwovens industry in India have the chance to inform themselves about the latest textile machinery solutions to make their textile business and products more sustainable and efficient.

Links with Indian textile industry

The textile sector is of great significance in the Indian economy, contributing more than 2 percent of the GDP and allowing the country to be the world's third-largest exporter of textile and apparel items.

India represents the third largest foreign market for the Italian textile machinery industry In 2022, the Asian Country imported Italian textile machinery for a total value of about 200 million euro. Referring to the first 9 months of 2021, the value shows a slight decrease compared to the value for the same period of the previous year.