25 July 2022, Mumbai:

Retail leasing across 2022 is expected to grow to its highest levels since 2018, says Market Monitor report by CBRE, an international property consultant.

In April-June 2022 quarter, retailers leased one million sq. ft. new space across malls and high streets of major cities during the April-June quarter, it adds. Retail leasing is expected to double in the second half of 2022 as many international brands have announced plans to enter India.

RELATED NEWS . COVID-induced restrictions lead to 50% decline in June retail sales: Retailers Association of India (RAI)

ALSO READ Pandemic provides India an opportunity to lead global fashion retail market

The overall leasing space is dominated by homeware and department stores, entertainment, and superstores while the share of fashion and apparel fell significantly to 28 percent from 41 percent in the previous quarter.

In the second quarter of 2022, the retail sector staged a recovery with transactions growing over 100 percent on a quarter-on-quarter basis, says Anshuman Magazine, CEO, India, South-East Asia, Middle East & Africa, CBRE.

Across cities, brands are resizing and recalibrating their physical store strategies to diversify their portfolio and expand their footprint, he adds. Project completion in the first half of the year grew over 500 percent compared to a year ago. Most project completions were noted in the Delhi-NCR with a 25 percent share, followed by Hyderabad, Bengaluru, and Chennai.

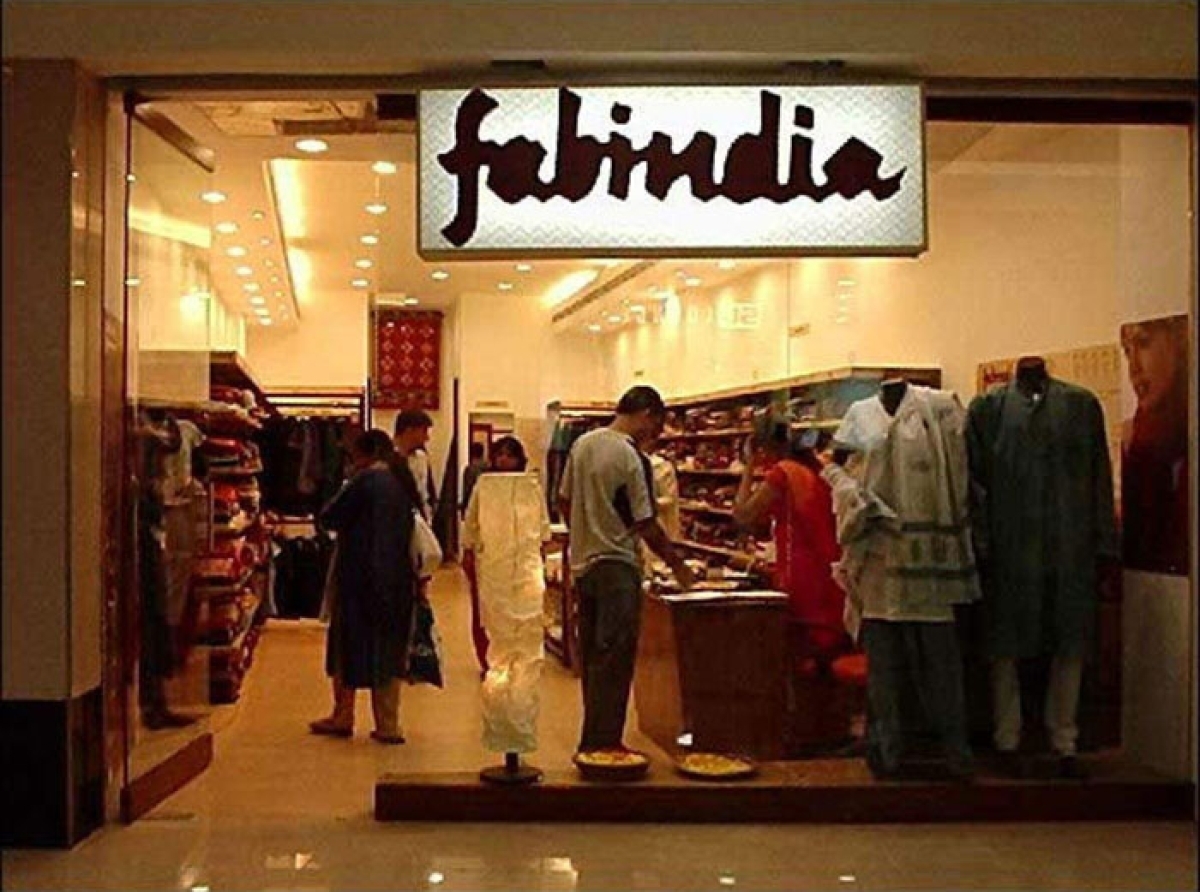

Despite an uptick in online shopping, brick-and-mortar retailers continue to focus on resizing, rightsizing, and relocating -to ensure long-term growth and broaden their customer base.

These sentiments will sustain in the near term despite retailers exploring innovative methods to drive sales via a mix of both physical and online stores, adds Magazine.

The report shows, that supply addition increased 523 percent to 0.81 million sq. ft. in the first half of the year. Most leasing activities were driven by fashion and apparel retailers with a 28 percent share. This was followed by homeware and department stores and entertainment centres.

During the last fiscal, the top nine companies, including Reliance Retail, Aditya Birla Fashion and Retail, DMart, and Tata's Trent, added 3,206 outlets to reach a combined store network of 22,803 stores, according to data sourced from their latest investor presentations.

Explore: Fashion Brand News l Apparel News l Lifestyle News l Retail News l Textile News l Trade News l Startup News

Join our community on Linkedin