5th Aug 2021, Mumbai:

Minister of State for Textiles Darshana Jardosh said in a written reply to the Rajya Sabha that due to the COVID-19 pandemic and national lockdown enforced by several states, manufacturing operations in all NTC Ltd mill facilities were placed on stop from March 25, 2020.

The government said on Thursday that no mills owned by National Textile Corporation (NTC) Ltd have been shuttered in the last two years. Minister of State for Textiles Darshana Jardosh said in a written reply to the Rajya Sabha that due to the COVID-19 pandemic and national lockdown enforced by several states, manufacturing operations in all NTC Ltd mill facilities were placed on stop from March 25, 2020.

Following the easing of the lockout and the availability of raw materials, NTC reopened 14 mill units in January 2021. In April 2021, she said, the second wave of the COVID-19 epidemic forced the shutdown of all NTC mill operations. According to the minister, NTC resumed operations at certain of its mills in July 2021, based on raw material availability, and the employees were paid monthly as per their status by NTC from its cash reserve.

https://www.linkedin.com/feed/update/urn:li:activity:6829330425106767872

"No mill has been shuttered under NTC Ltd, a Central Public Sector Enterprise under the Ministry of Textiles, in the previous two years," she noted. In a second response, she stated that SITP (Scheme for Integrated Textile Park) has sanctioned 66 parks. "24 parks have been finished in accordance with scheme criteria, 32 parks are operational and in various phases of implementation, and ten parks have been terminated," she explained.

TOP 5:

1. Malls in India to bounce back stronger post second wave

2. The Souled Store to expand product portfolio

3. In Q2, Under Armour maintains its growth trajectory and improves its outlook

4. Amazon India launches new 'Specialized Fulfillment Center' in Hyderabad

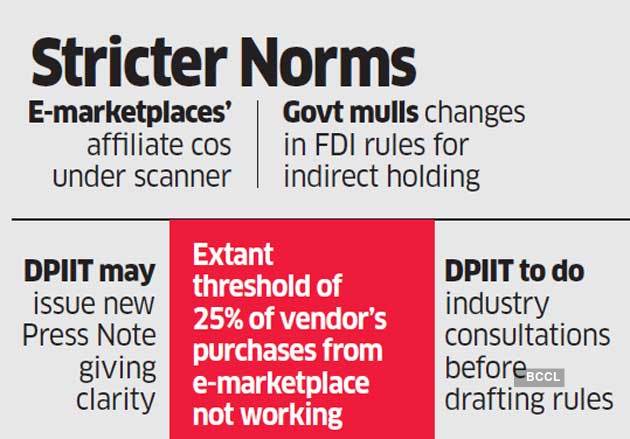

5. Flipkart vows to comply with Indian laws on FDI

_thumbnail.png)

.png)

_thumbnail.png)

1_thumbnail.png)

_thumbnail.jpeg)

_thumbnail.jpeg)

_thumbnail.png)

_thumbnail.jpeg)

_thumbnail.jpeg)

1_thumbnail.jpeg)

_thumbnail.png)

_thumbnail.jpeg)

_thumbnail.jpeg)